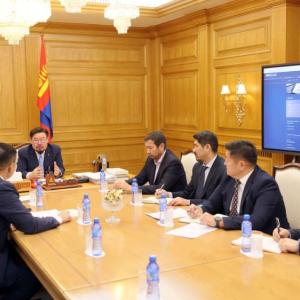

Tax Reform Proposal by Domestic Manufacturers to Be Reviewed

Politics

Ulaanbaatar, August

14, 2025 /MONTSAME/. The Economic

Development Council, which aims to support government activities by providing

professional assistance, coordinating timely economic development policies, conducting

research, offering recommendations, and fostering public-private cooperation, convened

on August 12, 2025.

Minister of Finance

Javkhlan Bold presented key points of tax reform discussions during the

meeting. A total of 176,000 proposals

were submitted by 13,000 contributors, including individual citizens, business

entities, the Mongolian National Chamber of Commerce and Industry, the

Mongolian Business Council, specialized tax consultants, and professional

associations. More than 50 percent of the total proposals were reflected in the

draft law, consistent with the guiding principle of maintaining economic stability.

Prime Minister

Zandanshatar Gombojav instructed the Ministry of Finance to carefully review proposals

to support the wealth creators and manufacturers who generate employment, noting

that the tax reform should support wealth creators, producers, and employers by

gradually increasing VAT refunds and eliminating the system in which taxpayers

are disadvantaged while non-compliant entities gain.

The Prime Minister stated

that the Government should draft a bill on “Freedom of Business Activity” within

the framework of ensuring the Council's operational stability, as well as

providing support and legal protection to private sector business operations.

A package of bills is currently

being developed to advance tax reform and provide support for the private

sector, employers, wealth creators, and industrialists. The members of the Parliament

are actively working to increase exports, promote trade, and implement changes

to customs control procedures.

Ulaanbaatar

Ulaanbaatar