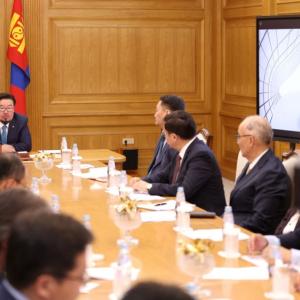

State Great Khural Endorses Credit Ratings to Improve Citizens’ Financial Planning

Politics

Ulaanbaatar,

August 13, 2025 /MONTSAME/. Although borrower information is

centralized in a database under the current legislation of the Law on Credit Information

of Mongolia, the utilization of the information or the approval of scoring

methodologies by the authority has not been regulated.

Therefore,

the Law on Amendments to the Law on Credit Information introduces new regulations,

including the determination of borrower creditworthiness, the setting of product

and service fees, the use of credit information exclusively for assessing creditworthiness,

and the prohibition of using such information for purposes not specified in the

law.

With

the adoption of the Law, citizens will be encouraged to develop a culture of

understanding their credit scores and making timely payments to improve them.

This will help individuals plan their business finances more effectively, enhance

financial discipline, correct any inaccuracies in the credit database, and

prevent other risky financial behaviors.

The

credit information database contains data on loans and payment obligations of

government and private sector organizations, citizens, and enterprises. The

data is supplied from 12 banks, 436 non-bank financial institutions,

telecommunications companies, ministry and agency-managed funds, and savings

and credit cooperatives. According to the Media and Public Relations Department

of the State Great Khural (Parliament) of Mongolia, the database stores loan information

of 1.6 million citizens and 19,600 enterprises as of this year.

Ulaanbaatar

Ulaanbaatar