Golomt Bank: The Open Bank vision driving a brighter future for Mongolia

Economy

A pioneering

financial institution is forging new paths for digital innovation and

sustainable development in a promising Central Asian economy.

Mongolia, a mineral-rich nation strategically located between China

and Russia, is bouncing back strongly from a pandemic slump – with the Asian

Development Bank (ADB) forecasting its economy to grow 5.4 percent in 2023.

While its development remains heavily dependent on coal, Mongolia’s

potential for sustainable development through renewable energy is enormous. The

ADB estimates its combined wind and solar potential to be enough to meet not

only its own energy demand – but also Northeast Asia’s needs with suitable transmission

infrastructure.

One of the chief ways the landlocked nation can invest in a brighter

future of sustainable and inclusive growth is through transition to a digital

economy, which can reduce its dependence on commodities exports and drive less

carbon-intensive industries.

“The Mongolian economy stands to benefit enormously from further

digitalization, which can boost productivity and support economic

diversification,” according to the United Nations Conference on Trade and

Development (UNCTAD), which in 2022 launched a partnership to boost Mongolia’s

digital economy.

Golomt Bank – one of the nation’s top three banks – is on a mission to

spearhead Mongolia’s digital transformation through a unique “Open Bank”

strategy that is creating a digital ecosystem with local innovators for

Mongolia’s social empowerment and sustainable growth.

Pioneering A.I.-enabled solutions and consistently strong financial

results – even during the pandemic – enabled Golomt Bank to make Mongolian

Stock Exchange history in November, 2022 with the bourse’s biggest ever initial

public offering, attracting MNT 118.8 billion.

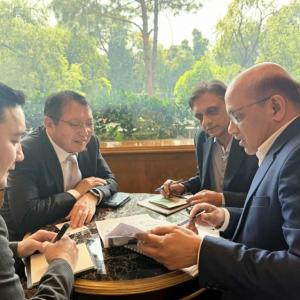

CEO Norihiko Kato and CIO Sainbileg Mandakh speak about the

digitally-driven future of an institution at the forefront of Mongolian

sustainable development.

What is Golomt

Bank’s vision of a bright future for all Mongolians?

NK: We’re keen to take a lead in the sustainable development of

Mongolia. Our motto “Investing

for a brighter future” means projects that drive eco-friendly,

community-friendly, positive change. We are proud to be one of the

founding signatories – and the only from Mongolia – of the United Nations

Environment Programme Finance Initiative. We’re also proud of our Diversity, Equity and Inclusion

record: 65 percent of our employees are women; 35 percent of our

executive management team members are female. As we drive social and sustainability programmes, our

financial future looks bright. Our latest revised business plans are all above

forecasts presented at our IPO.

Please tell us

about the vision behind Golomt Bank’s Open Bank strategy?

SM: The Open Bank model is about digital empowerment for all

Mongolians. We believe in a sharing economy, working with fin-tech and

non-financial sector partners, to reimagine a better future for Mongolia. The

vision is not only for banking and financial literacy solutions. Our aim is to

provide a digital ecosystem that encompasses sectors such as health, education

and agriculture. Our mission is to drive a collaborative digital economy across

the spectrum of Mongolian society. Open Bank is fundamentally about driving a culture of digital transformation – with

agility, commitment and imagination.

Please share the

unique value and operational highlights behind Golomt Bank’s historic IPO?

NK: We have a customer base built upon a bedrock of trust. As Mongolia’s leading bank, we command 20 percent of the banking sector. In 2022, our net profit increased 4.5 times from the previous year, while Mongolia’s economy grew by 4.8 percent. Trust is key. We’re Mongolia’s first bank to be rated with ‘Internal Audit Practices in line with the international standard and Code of Ethics.’ During the IPO, we pushed our Open Bank strategy forcefully. This digital future based on sound governance and innovation was probably the most appealing factor for investors in the IPO.

How does your

SocialPay digital wallet make you a pioneer in Mongolia’s online banking space?

SM: SocialPay, introduced in 2017, was the first fintech service in

Mongolia. It follows in a line of firsts for Golomt Bank. We introduced

Mongolia’s first international card payment system, its first Internet bank,

and first Smart Bank solution. SocialPay started as a peer-to-peer payment

system. Today it’s a lifestyle platform. For example, it includes an

A.I.-powered service that plans your family budget. During the pandemic,

SocialPay enhanced health-and-safety through contactless payment. An exciting

new version is coming soon with features such as Natural Language

Processing-enabled transactions. We strive every day to create new digital

value for wellbeing and sustainable development.

Find out more about Golomt Bank’s pioneering Open Bank solutions Here.

Source: The Banker

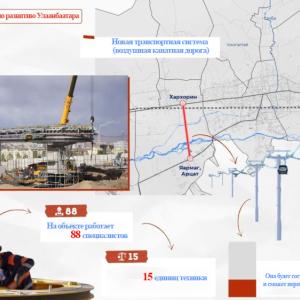

Ulaanbaatar

Ulaanbaatar