Bill on State Budget amendment submitted

PoliticsUlaanbaatar /MONTSAME/ Today, March 24, Finance Minister B.Choijilsuren submitted a bill on 2017 Budget Amendment to Parliament Speaker M.Enkhbold. The budget amednment has been developed within the framework of policy measures to realize IMF’s Extended Fund Facility program.

Some policy measures are reflected in the bill on budget adjustment as planned in the scope of the program, stated Finance Minister B.Choijilsuren. Those include:

1. Excise tax on cigarettes, tobacco, vodka and alcoholic beverages and similar items as well as customs duty on imported cigarettes will be increased

2. Excise tax on petroleum and diesel will be up within limits indicated in relevant law.

3. Excise tax on passenger car will be up.

4. Individual Income tax will have tax brackets.

5. Start enforcement of tax on savings interest

6. Social insurance contributions will be raised.

In reducing budget expenditure, the Ministry adhered to principles to have social welfare focus on targeted group with low income, to lower additional loads to the budget caused by changes in population structure and legal reform, to renew pension system, to link salary to budget capability and improve efficiency of expenditures.

1. Efficiency of procurement of medicine and medical materials should be improved.

2. Retirement age will be raised in stages in line with changes in formation of population age and senior employment will be supported.

3. To increase the number of small and medium enterprises to back economic activation and to provide people with jobs; to start meat and milk campaigns in agriculture and continue ‘Cultivation-III' campaign

4. Current salary level of state employees will be kept till the end of 2018 in order to avoid discharging public employees in time of economic and financial difficulties and new appointments should not be made to replace the released employees from public service according to their rights till the end of 2019.

5. Child allowance will be distributed only to targeted group and the allowance will not be refunded.

6. Families of targeted group will be supported with food supply and social welfare programs will be merged and actions to make them proper will be started.

7. Some new laws will be changed as they would influence to increase budget expenditure.

As a result of these measures, total revenue of the 2017 state budget will be MNT6.015.7 billion or equal to 23.1 per cent of GDP and expenditure will be MNT8.789.8 billion or equal to 33.7 per cent of GDP, making the budget deficit MNT2.774.1 billion or equal to 10.6 per cent of GDP, introduced Finance Minister B.Choijilsuren.

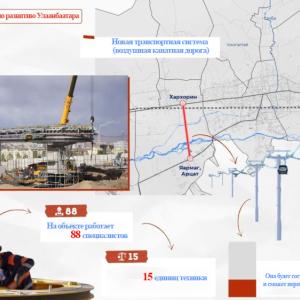

Ulaanbaatar

Ulaanbaatar