Payment cards to be reformed

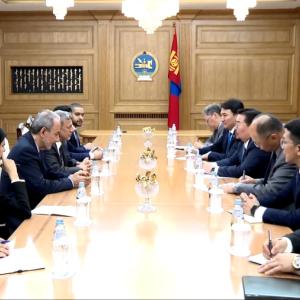

EconomyUlaanbaatar /MONTSAME/ The first meeting of the National Council of Payment System was held on November 19. The Bank of Mongolia (BoM) established the council in accordance with the Law on National Payment System that took effect on January 1, 2018.

Representatives of the Financial Regulatory Commission, Communications Regulatory Commission, Non-Bank Financial Institutions (NBFI) and the Central Securities Depository discussed rules of the council, the central bank's policy on payment system and ongoing reforms at the meeting.

BoM is planning to implement a project on payment system reform next year. “Reformation of payment system will result in a renewal of existing payment systems for inter-bank transactions, and introduce the international technology and infrastructure that will increase the number and types of transactions and provide fast and reliable services,” said E.Anar, Head of the BoM Payment Systems Department.

There are currently 4 million payment cards in Mongolia, 2.7 million of which are used for internal transactions. Within the reform, the cards will be renewed with chip cards next year. Thus, it will be possible to make payments through mobile phones by connecting the chip with the phone. It is also considered that the reform will improve the payment security.

According to the Law on National Payment System, only commercial banks have been involved in payment systems. However, with the engagement of the fintech companies and NBFIs approved by the BoM, the rules and regulations were changed.

“Currently there is only one official digital currency in Mongolia, Candy. A number of companies having similar tools have submitted their request for making the tool a digital currency and we are reviewing them. Decision on the next digital currency haven’t been made yet,” noted Vice President of BoM B.Lkhagvasuren.

Ulaanbaatar

Ulaanbaatar