IMF Executive Board Concludes 2021 Article IV Consultation with Mongolia

Economy

Washington, DC – November [19], 2021: The Executive Board of the International Monetary Fund (IMF) concluded the Article IV consultation with Mongolia.

The Mongolian economy is rebounding from its deepest

recession in a decade, despite a lingering pandemic. The recovery is largely

export-led, supported by the global recovery and base effects. Notwithstanding

continued economic support and a successful vaccination program, domestic

activity remains weak due to the pandemic. Many workers, especially female

workers, are leaving the workforce, perhaps permanently. Inflation has risen

recently but mainly due to transitory factors affecting import prices. Policies

were appropriately supportive during the pandemic. However, large, untargeted

and continuing fiscal, quasi-fiscal and financial forbearance measures due to

Parliamentary measures have heightened macrofinancial vulnerabilities: public

debt has sharply increased, bank balance sheets have further weakened, and the

Bank of Mongolia’s (BOM) operational independence has been compromised.

The government and BOM have appropriately managed

Mongolia’s external vulnerabilities. Taking advantage of supportive global

financial conditions, Eurobonds coming due in 2022−23 were successfully rolled

over on better terms. The BOM has opportunistically built its gross

international reserves, aided by import compression and disruptions, a favorable

terms of trade and the 2021 IMF SDR allocation of US$98.3 million

(95.8 percent of quota). Even so, international reserves are assessed to

be inadequate given large external liabilities.

The economic outlook remains strong, though uncertain. Real

GDP is projected to grow by 4.5 percent in 2021, after contracting by 4.6

percent in 2020. In 2022-23, Mongolia remains poised for an export‑led boom,

with growth expected to accelerate to 6½–7 percent if export portals fully

reopen and the Oyu Tolgoi copper mine is completed on schedule. As the

pandemic is largely controlled, domestic activity is expected to gradually

normalize. Medium term growth is expected to moderate to 5 percent, but output

levels are likely to remain below pre-pandemic trends due to permanent losses

in activity. Inflation is expected to return to the BOM’s targeted range. Despite

an export price boom, the 2020 current account improvements are likely to be

temporary once recovery takes hold and imports pick up. This reflects Mongolia’s

lack of export diversification, heavy import dependence and high external

debt.

Executive Board Assessment

Executive Directors commended the authorities on a

successful vaccination campaign and welcomed the export-led recovery underway.

Notwithstanding the strong economic outlook, Directors noted that significant

downside risks remain given uncertainties associated with the pandemic,

Mongolia’s limited buffers and high external public debt. In that context, they

stressed the importance of managing the export boom prudently to secure the

recovery while achieving the country’s long-term development goals.

Directors agreed that in the near term, policies may need to

remain supportive, given the lingering pandemic and weak recovery in domestic

activity. Calling for an ambitious fiscal consolidation strategy, Directors

emphasized the importance of bold structural fiscal reforms to address

untenable debt dynamics. To this end, they underscored the importance of better

targeted and more effective social assistance programs, ambitious pension

reforms, improved public investment management, and tax administration.

Commendable plans for e-governance and state enterprise reform should be

fleshed out and implemented. Directors also emphasized that the integrity of

the Future Heritage Fund should be preserved to maintain investor confidence.

Directors stressed the need to enhance the Bank of

Mongolia’s (BOM) operational independence to ensure monetary and external

stability. Continued vigilance is needed to ensure that inflation does not

become persistent. Directors emphasized that quasi-fiscal operations should be

moved to the budget and phased out, and the Parliament should resist making

decisions on monetary and financial operations. Greater exchange rate

flexibility could serve as a shock absorber. The BOM should continue building

its external buffers and drawdown non concessional external liabilities.

Noting with concern the possibility of potential

vulnerabilities in the banking sector, Directors called for greater supervisory

focus on strengthening banks and contingency planning. In that context, they

stressed the importance of a well-sequenced approach to bank reforms to

minimize the risk of systemic instability. Phasing out regulatory forbearance

by end-2021 and promptly undertaking a fresh and independent asset quality

review for potentially capital deficient banks would be imperative for

transparency and a proper assessment of bank balance sheets. Emphasizing the

need for putting in place the necessary pre conditions for successful IPOs and

contingency plans, they called for delaying the deadline for the IPOs.

Directors welcomed the authorities’ long-term development strategy focused on sustainable, inclusive, and green growth. To improve the business climate, they urged the authorities to decisively address the long standing concerns about corruption, governance, and AML/CFT to strengthen the investment climate and promote diversification. Revamping the insolvency framework and judiciary reforms should be prioritized to address impaired balance sheets. Directors stressed the importance of the publication of the full audit report on COVID related expenditures, including the missing information on beneficial owners.

|

Population (2019):

3.4 million |

GDP per capita: 3,965 |

|||

|

Quota: SDR 72.3

million |

(U.S dollars, 2020) |

|||

|

Main products and

exports: Copper, coal, gold and cashmere. |

Poverty headcount ratio: 28.4 |

|||

|

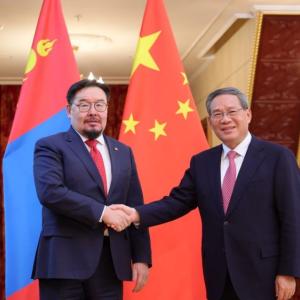

Key export markets:

China, Russia. |

(% of population, 2018) |

|||

|

|

||||

|

|

2020 |

|

2021 |

2022 |

|

|

Act. |

|

Proj. |

|

|

|

|

|

|

|

|

|

(In percent of GDP, unless otherwise

indicated) |

|||

|

Output |

|

|

|

|

|

Real GDP growth (percent change) |

-4.6 |

|

4.5 |

7.0 |

|

Prices |

||||

|

Consumer Prices (EoP; percent change) |

2.3 |

7.5 |

7.0 |

|

|

General government accounts |

||||

|

Primary balance (IMF definition) |

-6.7 |

-3.1 |

-1.1 |

|

|

General government debt 1/ |

77.4 |

81.5 |

76.8 |

|

|

Monetary sector |

||||

|

Credit

growth (percent change) |

-3.9 |

9.0 |

11.0 |

|

|

Balance of payments |

||||

|

Current

account balance |

-5.1 |

-12.8 |

-12.8 |

|

|

Exports

of goods (y/y percent change) |

-2.7 |

12.1 |

17.9 |

|

|

Imports

of goods (y/y percent change) |

-13.1 |

31.5 |

13.6 |

|

|

Gross

official reserves (in USD millions) 2/ |

4534 |

|

4243 |

4508 |

|

Exchange rate |

||||

|

Togrog

per U.S. dollar (eop) |

2850 |

… |

… |

|

|

|

|

|

|

|

|

Sources: Mongolian authorities; and Fund staff

projections. |

||||

|

1/ General government debt data excludes SOEs debt and

central bank’s liabilities from PBOC swap line. |

||||

|

2/

Gross official reserves includes drawings from swap line. |

||||

Ulaanbaatar

Ulaanbaatar