Bill on state budget 2023 to be submitted to the Parliament

Politics

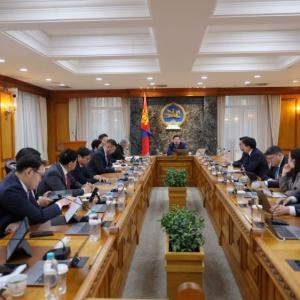

Ulaanbaatar/MONTSAME/. The Cabinet discussed at its last week’s regular meeting

bills on the Budget Framework Statement for 2023 and Budget Assumptions for

2024-2025, 2023 State Budget Law of Mongolia, 2023 Budget Law of the Social

Insurance Fund, 2023 Budget Law of Health Insurance Fund, 2023 Budget Law of

the Future Heritage Fund and accompanying bills. As proposed by the Prime

Minister and members of the cabinet, it was decided to reconsider the bills this

week after including the policies and measures to be implemented in the next

year. Accordingly, the Cabinet discussed bills again at this week’s meeting and

decided to submit them to the Parliament.

Following the Cabinet meeting, Minister of Finance B.Javkhlan gave information about the cabinet’s decision. He said, “At a time when international organizations predict that the global economic crisis will continue until 2024, the Government aims to pursue strict monetary policy and fiscal austerity policy towards the reduction of the balance of payments deficit and protecting foreign currency reserves.

Therefore, the government's budget policy for 2023 is directed

towards the following objectives, aiming to implement state austerity policy,

promote the New Revival Policy, reduce the import pressure and stabilize macro

economy through the optimal distribution of resources.

One. To implement

legislations regarding state austerity,

Two. To intensify

reforms in the budget financing system in health and education sectors aimed at

the quality, performance, and outcomes of public services; to introduce the

reform in other sectors; and to improve the civil service salary system in line

with productivity,

Three. To

implement debt management strategies optimally,

Four. To direct

social protection to target groups within the framework of the policy

‘from-welfare-to-work’,

Five. And

implement policies to decentralize by ensuring the balance of urban and rural

development, reduce traffic congestion, as well as to carry out tax policies

towards the creation of favorable environment for investment, jobs and doing

business in rural areas.

Ulaanbaatar

Ulaanbaatar