Mongolia to Encourage Domestic Enterprises to Raise Funds from the Domestic Bond Market

Economy

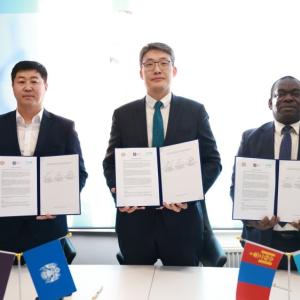

Ulaanbaatar, April 18, 2025 /MONTSAME/ On April 17, 2025, the "Bond Forum-2025" was organized under the initiative of the Chairman of the State Great Khural (Parliament) of Mongolia.

At the Forum, representatives from the Financial Regulatory Commission of Mongolia, the Mongolian Stock Exchange, the Mongolian National Chamber of Commerce and Industry, international financial institutions, domestic enterprises, investors, and issuers of securities attended. The representatives discussed the importance of developing the domestic capital market, particularly in exchanging government securities, setting benchmark interest rates, and the challenges and solutions of bond issuers and investors.

Securities trading in Mongolia reached MNT 1.58 trillion last year, a twofold increase compared to 2023, with corporate bonds accounting for around 60 percent. Orders for the Government's short and medium-term bonds, issued on April 16, 2025, exceeded the trading volume by four times. Moreover, six-month bonds received 4.6 times more orders, and 24-month bonds received 4.2 times more orders worth MNT 43.7 billion. The bond market is developing in Mongolia year after year. Experts emphasize the importance of increasing the opportunities for large companies to raise funds by issuing bonds in the capital market in the future.

Director of the Securities Market Department of the Financial Regulatory Commission Dulguun Battulga said, "The majority of large enterprises around the world are joint-stock companies. In Mongolia, around 10 percent are open joint-stock companies. To increase this number and create more responsible and transparent companies with good corporate governance, we have approved a program with measures to attract Top-100 enterprises to the capital market. The companies will be able to attract the necessary medium and long-term funds from the bond market. While some types of bank loans have a short term, there is no such limit for bonds, allowing companies to plan their finances in the long term."

Director of the Securities Market Department of the Financial Regulatory Commission Dulguun Battulga said, "The majority of large enterprises around the world are joint-stock companies. In Mongolia, around 10 percent are open joint-stock companies. To increase this number and create more responsible and transparent companies with good corporate governance, we have approved a program with measures to attract Top-100 enterprises to the capital market. The companies will be able to attract the necessary medium and long-term funds from the bond market. While some types of bank loans have a short term, there is no such limit for bonds, allowing companies to plan their finances in the long term."

Director of the Investment Department of the "Golomt Capital" LLC M. Narangerel said, "The bond market has been developing rapidly with the establishment of an over-the-counter market regulatory environment in 2021. However, while government and local bonds are issued with long maturities, the company's bonds are issued with shorter maturities, with a maximum maturity of 24 months. It is difficult to implement new projects in the industrial and infrastructure sectors with such short-term bonds. Companies will be more interested in issuing bonds if the interest rate, term, and basic conditions of the bonds are made more flexible."

Director of the Business Development Department of the Mongolian Stock Exchange T. Khash-Erdene remarked, "There are 13 companies registered as open joint-stock companies in the Mongolian Stock Market. These have issued bonds worth about MNT 300 billion in the past. To increase the number of open joint-stock companies, we plan to make reforms to the bond registration procedure, simplifying the registration process in terms of time and reducing the cost of bond issuance, including payment fees and commissions. Also, there will be no collateral requirements for bonds with a certain value and term. Companies raise money to expand their businesses. We will pursue a policy of supporting national producers in the bond market."

Ulaanbaatar

Ulaanbaatar