Government Submits Draft 2026 Budget Totaling MNT 31.6 Trillion

Politics

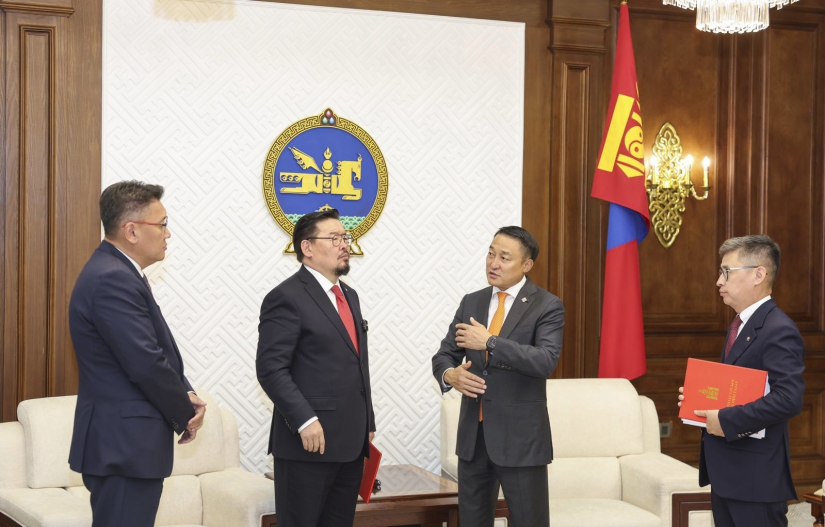

Ulaanbaatar, September 2, 2025 /MONTSAME/. Prime Minister of Mongolia Zandanshatar Gombojav submitted to Speaker of the Parliament Amarbayasgalan Dashzegve the 2026 Budget Framework Statement for the Unified Budget of Mongolia, the draft law on amending the Budget Projection Law for 2027-2028, and the draft law on the 2026 State Budget on September 1, 2025.

The balanced revenue of Mongolia’s 2026 Unified Budget is projected at MNT 31.6 trillion, while total expenditure is estimated at MNT 32.98 trillion. The budget balance is projected to have a deficit equivalent to 1.3 percent of GDP. Prime Minister Zandanshatar stated that the 2026 budget policy aims to ensure macroeconomic fiscal stability, limit the growth of public expenditures, increase citizens’ income, and maintain and further improve the quality and accessibility of basic social services at the current level.

The tax reform package is being discussed through the D-Parliament electronic platform starting September 1, 2025. This legislative package is designed to ease the tax burden by MNT 3-4 trillion, benefiting individual taxpayers and business owners. The prime minister emphasized that the proposed budget seeks to limit state intervention while expanding and supporting the private sector.

For the first time, the government has developed its budget based on public input. A total of 186,000 citizen opinions were collected through the E-Mongolia digital platform, while 239,000 individuals participated in public discussions held both in-person and online, organized by general budget governors. Among the submissions, 8,800 were duplicates. This initiative marks a significant milestone in ensuring broad citizen participation in the national budget process.

During the voting process, citizens expressed a strong desire to improve the quality and accessibility of basic social services, ensure a safe and reliable living environment, reduce budget expenditures, and increase income by lowering the tax burden. Based on this public input, several specific measures have been incorporated into the budget, including:

1. Education Sector Goals and Teacher Compensation:

In connection with the government’s declaration of 2026 as the “Year of Education”, a national goal has been set to achieve 100 percent enrollment in education and to reduce class sizes to meet standard levels. As part of the medium-term plan extending to 2028, the government will construct 95 kindergartens and 108 schools with equipment and supplies provided in phases. To support this initiative, MNT 1 trillion will be invested in the education sector next year through a combination of state budget allocations and foreign loans. Additionally, variable expenses in the education sector have been increased by MNT 100 billion to implement a salary structure that accurately reflects teachers’ workloads starting in 2026.

2. Health Sector Budget Priorities:

A total of MNT 1.3 trillion will be invested in the health sector, funded through the state budget and foreign loans. Under this initiative, construction will begin on specialized hospitals for cancer treatment, cell and organ transplantation, and cardiovascular care. Additionally, hospital buildings in 17 aimags will be renovated with targeted improvements to intensive care and emergency services. These facilities will also be equipped with essential medical equipment to ensure timely and effective treatment.

3. Social Welfare and Insurance:

To support pensioners and insured individuals, an additional MNT 378 billion will be allocated to raise social insurance and welfare pensions by 6 percent.

4. VAT Refund Measure

In an effort to reduce the tax burden on citizens, the government will increase the VAT refund by 50 percent, not

exceeding MNT 1 million.

5. Public-Private Financing in the Energy Sector:

The government has planned MNT 3.9 trillion for investment in the energy sector next year, sourced from MNT 373.3 billion in state budget funds, MNT 351.8 billion in foreign loans, and MNT 150 billion from bonds. The majority of the funding, MNT 2.566 trillion, will be provided by private companies.

6. Fiscal Consolidation and Budget Discipline:

In 2026, economic activity is expected to slow due to falling prices of key export commodities, reduced domestic consumption, and weakened investment conditions. Fiscal space will remain constrained at the previous year’s level, 24.0 percent of GDP, and state institutions will operate under austerity measures. Current expenditures are to be reduced by MNT 641.7 billion compared to the projected performance in 2025. These savings will be achieved through reductions in institutional operating costs, subsidies, incentives, and interest rate discounts across sectors, along with temporary deferrals in benefit payments to public sector employees.

7. Sovereign Wealth and Asset Management:

Mongolia’s National Sovereign Wealth Fund’s savings have continued to grow, with the Future Heritage Fund currently holding MNT 4,706.1 billion and the Savings Fund holding 654.4 billion, bringing the total to 5,360.5 billion. In 2026, the Sovereign Wealth Fund is expected to increase by an additional MNT 2,956.1 billion. Alongside this growth, policies aligned with sound asset management principles and a stable housing finance mechanism for citizens will be introduced within the banking and financial system. Citizens will be able to view their Savings Fund balances through the E-Mongolia electronic platform.

Ulaanbaatar

Ulaanbaatar