Digital signature introduced in banking sector

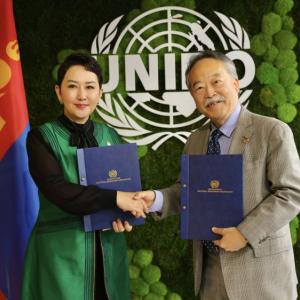

EconomyUlaanbaatar /MONTSAME/ On October 10, Deputy Governor of the Bank of Mongolia (BoM) B.Lkhagvasuren received the first e-token for the digital signature system from Tridum e-Security LLC, which carried out a project on digitizing financial services in Mongolia and introduced digital signature system under the launch of Digital Payment campaign, running between October 10 and December 10.

Mr. B.Lkhagvasuren said “BoM, in accordance with its legal obligation to coordinate payment system in Mongolia has been providing card settlement so far. Technological development in the banking sector allows to fulfill the objective of delivering simpler, faster and more secure financial services to the customers. Thus, in order to promote this type of fintech service, we are launching this campaign. Now, Mongolia’s banking system is being digitized through the introduction of digital currency and smart payment card even though we started using payment cards just recently.”

Financial sector’s quick adaptation to the technological revolution is creating an opportunity to make banking service simpler, faster and more accessible to the citizens, added the Deputy Governor.

E.Anar, Director General, Payment Systems Department at BoM emphasized that introduction of the digital signature system enables fast and secure information exchange between BoM and the commercial banks and he showed the system’s way of working with his own signature as an example.

Ulaanbaatar

Ulaanbaatar