B.Bayarsaikhan: Making IPO will bring significant progress to the development of Tavantolgoi deposit

Economy

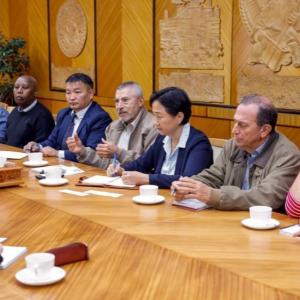

Ulaanbaatar/MONTSAME/. During

the ‘Invest in Mongolia, Shanghai 2019’ forum, the MONTSAME Agency’s reporter

interviewed Chairman of National Development Agency (NDA) and Chairman of the Board of Directors of ‘Erdenes Tavantolgoi’ JSC B.Bayarsaikhan about Mongolia’s policy on trade, investment and development and present conditions of Erdenes Tavantolgoi JSC.

-

‘Invest in Mongolia’ is often organized in the world’s large cities and

markets. What do you consider the significance of the forum?

-On the occasion of the 70th anniversary of diplomatic relations between Mongolia and China, this year ‘Invest in Mongolia’ forum has been organized in Shanghai during the China International Import Expo. Shanghai’s Yangpu District, co-organizer of the forum, has a development goal to be the hub of innovation and technology in the near future, which increases mutually beneficial cooperation opportunities between companies of the two countries operating in this sphere. The ‘Invest in Mongolia’ forum is also planned to be organized next month in Tokyo in collaboration with Japan’s Ministry of Economy, Trade and Industry and its Small and Medium Enterprise Agency. Overall objective of the forum in Tokyo is to build direct contacts between Mongolia’s SMEs and light production owners and Japanese businessmen. We consider that it will be more effective if the forum is further organized with the emphasis on a certain sector in tune with the specific features of a particular country.

-At

China International Import Expo, more than 170 countries introduced their

opportunities. For Mongolia, there are numerous advantages, such as the two

countries are neighbors and experience friendly relations. The sides aim to increase

bilateral trade turnover to USD10 billion by 2020. Is it potential to make it

over USD10 billion?

-Mongolia-China joint statement on deepening comprehensive strategic partnership states a goal to increase bilateral trade turnover to USD10 billion by 2020. Currently, mining products or coal export predominate the bilateral trade. It is likely to be kept even further.

In the view of the potential to reach USD10 billion by coal export only, the boost of non-mining goods trade can create many new opportunities.

To do it, it needs to improve the capacity of border checkpoints

of the two countries and establish free trade zones. Currently, Mongolian coal

is being exported to China through

Gashuunsukhait border checkpoint only. The National Development Agency is

focusing on increasing the checkpoints to cross coal within the public-private

partnership. New checkpoints Tsagaandel

Uul-Ulzii and Khangi –Mandal will be soon ready for export of mining products.

-Is

there any negative impact of the periodical decline of China’s investment to

Mongolia?

-China’s investment makes up over 20 percent of Mongolia’s total foreign investment, but in recent years it tends to decrease. For Mongolia, it is important to conduct trades and increase supply of value-added products rather than attracting investment. We have huge underground and surface resources and reserves of raw materials. Therefore, attracting more investment from highly developed countries such as Japan and Germany to process raw materials and distributing to Chinese market will be highly efficient and strategically significant.

-In

the ‘Three-pillar development policy, the agricultural sector has been

identified as a priority for development. However, the mining sector, main

pillar of the economy that produces over 80 percent of the country’s total

export, should not be ignored.

-According to the duty given by Prime Minister U.Khurelsukh, the NDA formulated ‘Three-pillar development policy’ based on the documents including Government Plan of Action 2016-2020, Sustainable Development Vision-2030 and Economic Recovery Program and others. It clearly reflected 27 goals and identified activities to be taken by Government within 900 days. It asserts to put a basis to reform economy, which has too much dependence from extractive sector, by means of developing non-mining sectors, in particular agricultural sector as a priority. Nevertheless, the development of extractive sector cannot be ignored. Projects that create value-added mining products need to be supported. It requires to develop heavy industry to process mining output. Development of heavy industry requires the great amount of money and specialized workforce. On the contrary, developing agricultural sector by a way of promoting SMEs will be efficient and cost-effective and require less investment.

-What

does the NDA pay special attention on when defining the 2050 vision and

development policy of Mongolia?

-World countries usually define their development policy for 30-40 years. The Law on Mongolian Development Policy and Planning states that the long-term policy and vision for 15-20 years shall be defined. The law needs to be reconsidered to lengthen this period and make it coherent with the government policy and platforms of political parties. For instance, Japan defined a 140-year development vision until 2160, which was adopted by its government four years ago. In regard with aging and shrinking population, Japan necessitated to determine its development policy for longer period in order to maintain its economy, which is ranked at 3rd in the world. If it runs successful, Japan’s population, which started shrinking from 2008, is expected to be stable from 2090 and grow again from 2110. Kazakhstan defined its development policy until 2050. In harmony with its long-term policy, the country developed its mid-term development policy, government plan of action and budgets and is now successfully implementing. In general, our country has a four-year plan of action. There are many cases that mega projects without the feasibility study and detailed research, which were included in the development programs, are not realized. Mongolia’s vision and development policy until 2050 aims to raise the percentage of middle class to 80 percent. We are working to put this over 1000-page document into discussions of all levels to develop the most optimal version that meets features of our country and make it ready by next spring. This work mobilizes 13 ministries, all agencies, scholars and experts.

-How

did Mongolia define its development policy and vision before?

-During the socialism, it used to work out a plan of action for five years, which effectively nurtured development of industrialization. This practice was basically abandoned after the transition to market economy. Failures and mistakes of the past 30 years directly connect with the lack of integrated development policy. For example, when checking policy documents approved during this period, there were over unintegrated 500 documents. It must be talked about development after determining accurate vision and goals.

-

Taking an advantage, I would like to ask about preparations of Erdenes

Tavantolgoi JSC to make IPO. Have the banks to make IPO been selected? How is

the progress going forward?

-Based on relevant resolutions of the Board of Director of Erdenes Tavantolgoi JSC, Parliament and the Government of Mongolia, some important resolutions in regard with making IPO have been issued and we are working hard to achieve the goal by May, 2020.

Bank of America Merrill Lynch and Credit Suisse have been preliminarily selected as sponsors while Bank of China International and Nomura Groups were also selected as joint coordinators.

Law firms and auditing companies also started working. We believe that with present intensity we can make IPO to the possible extent by May next year, which will make substantial progress to the development of Tavantolgoi deposit.

-It

is said that approximately USD1 billion is estimated to be gained. Please

clarify about making IPO to the possible extent?

- Erdenes Tavantolgoi JSC founded its subsidiary ‘Erdenes Tavantolgoi Mining’. We plan to transfer a mining license to this company and trade 30 percent of its shares at Hong Kong Stock Exchange. The amount of capital to be gained from it will depend on how much auditing companies valuate reserves of the ‘Erdenes Tavantolgoi Mining’ company. The 30 percent of the company’s shares can be valued at USD1 billion, USD2 billion or USD3 billion.

L.Nandintsetseg

Ulaanbaatar

Ulaanbaatar