Is the Graduated Income Tax Fair?

Economy

Ulaanbaatar, February 8, 2023 /MONTSAME/. During the last year's World Economic Forum, the Global Association of Billionaires and Millionaires, which has a membership of more than 500 people, called for an increase in taxes on ultra-high earners. The world's tendencies suggest expanding the economy by increasing the social influence of high-income earners.

From these tendencies, our authorities decided to commence this worldwide reform, amending the Law on Personal Income Tax starting from January 01 of this year. The government began to impose a graduated rate income tax on the salary income of citizens.

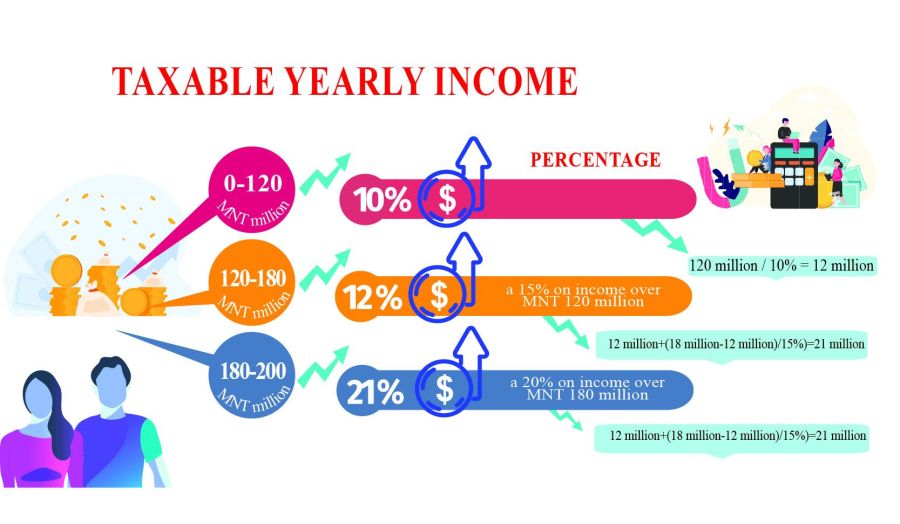

Specifically, the graduated or progressive tax imposes a 10% tax rate on citizens with MNT 0-10 million-salary income, a 15% tax on MNT 10-15 million-salary income, and a 20% tax on MNT 15-20 million- salary income on monthly basis. The law enforcement officers informed that 99.9 percent of citizens, or 817 thousand individuals, would not need to be concerned about this graduated rate income tax. According to them, 1304 individuals have higher than MNT 10 million monthly income, and 57 individuals have more than MNT 1 billion salary income per year.

The General Department of Taxation (GDT) reported that it was based on the 2021 database and it would be updated with the 2022 data. According to the Chairman of the GDT, B. Zayabal, 1361 individuals belong to the graduated income tax, of which 700 individuals are in 15% tax brackets and 660 in 20%. It will take only 0.1% of our population.

There arises a question if this law amendment induces the current economic situation on some level. As an answer to this question, the GDT stated that a total of MNT 12.5 billion would be collected from those 1361 individuals.

Let us

see in detail the percentage of graduated taxes for other countries. One

hundred thirty-one countries of the world have implemented a progressive tax

system. Eighteen developing countries are still using flat-rated tax. For the

United States, the tax rate brackets range from zero to 39.6 percent, and the

citizen with an average income pays 14.6 percent. Based on this information,

the amount of Personal Income Tax that our country collects from the income of

MNT 20 million is 6.4 percent higher compared to the average salary in the

United States. In this way, experts point out that imposing higher taxation

than the developed countries might exaggerate the unfairness and discourage

high-income citizens.

Indeed, international organizations advise our country to consider graduated rate tax for more extensive reform. For example, the International Monetary Fund noted, “The Government of Mongolia needs to increase tax transparency. According to a study, one out of every three people in Mongolia lives in poverty. It is unfair to impose a flat-rated tax when the ratio of the rich and the poor among the population is tremendously different, like heaven and earth. Therefore, it is essential to mobilize entire domestic resources by establishing a progressive tax system that increases according to income level.” In accordance with the International Monetary Fund's recommendations, we should introduce the basic principles of graduated rate income tax based on research, considering social inequality.

Ulaanbaatar

Ulaanbaatar