Speaker Zandanshatar: Tax Reforms will Target to Support National Producers

Politics

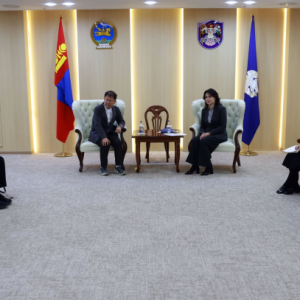

Ulaanbaatar, February 21, 2024 /MONTSAME/. Chairman of the State Great Khural Zandanshatar Gombojav, Member of Parliament and Chairman of the Budget Standing Committee Temuulen Ganzorig worked at the Mongolian Tax Authority on February 19, 2024, to exchange opinions on comprehensive tax reforms and reforms in public financial management initiated by the Parliament.

At the beginning of the meeting, Commissioner of the Mongolian Tax Authority Ch. Chimidsuren presented the functions, activities, and

goals of the tax offices, updates in services and standards, progress of digital

development, and related research and data. Speaker Zandanshatar

clarified resolutions of tax disputes regarding value-added tax, royalty, inheritance tax, and real estate tax as

proposals were made during the series of meetings with taxpayers and

enterprises.

Noting that taxes are not only for generating budget revenue

but also a mechanism for regulating the economy, the Chairman of the State

Great Khural underscored that tax policy should target to support job creators and

national producers and to create a stable favorable business environment.

According to the

Decree No. 37 of the Chairman of the State Great Khural dated February 17, 2023,

a working group in charge of analyzing the tax environment, studying the questionable

issues, making suggestions and conclusions, and, if necessary, developing and

presenting a draft decision on tax reform was established headed by Chairman of

the Budget Standing Committee.

The members of the working group have held 15 meetings with the

attendance of about 300 taxpayers, openly discussing the issues of tax burden, regulations,

and rules that supersede laws and cause difficulties in the operations of entities.

As complained by taxpayers the most pressing issue is that the normative legal acts issued to implement tax laws exceed the laws, as well as the so-called service fees or charges set by some government organizations create as much burden as taxes, said Chairman of the Budget Standing Committee G. Temuulen. "Therefore, the Parliamentary Resolution on Measures to Invalidate Fees, and Charges that do not comply with the laws and regulations, which cause financial burden, and bureaucracy to citizens and enterprises was approved, as recommended by the Working Group established by the order of the Speaker, " MP Temuulen emphasized.

It is planned to implement comprehensive tax reforms and reforms

in public financial management initiated by the Parliament in three stages, and

long-term policy documents on tax issues will be developed based on the results

of the reforms.

Ulaanbaatar

Ulaanbaatar