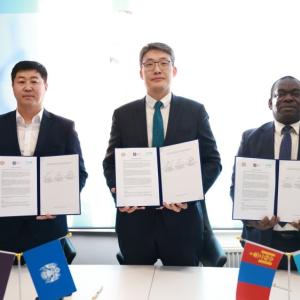

Financial Regulatory Commission Chairman meets EBRD Resident Representative

Society

Ulaanbaatar /MONTSAME/. Mr D. Bayarsaikhan, Chairman of the Financial Regulatory Commission of Mongolia met with Hannes Takacs, the Resident Representative of the European Bank for Reconstruction and Development (EBRD) in Mongolia.

At the meeting, the two parties discussed the implementation and outcomes of ongoing projects. For example, within the framework of the ‘Support for the legal framework on non-bank financial institutions in Mongolia’, a draft law to amend the Law on Non-Bank Financial Activities was developed, and collaboration will continue in organizing public consultation. Discussions also included attention to the project ‘Policy design and Recommendation for Green Capital Market Incentives for Sustainable Development’.

The parties also exchanged views on banking sector reform, including, increasing the banking sector's risk-bearing capacity, reducing equity concentration, and increasing investor interest in the long-term. It was decided to cooperate, in the minimization of risks associated with virtual asset service providers and cryptocurrencies.

Mr Bayarsaikhan thanked Mr Takacs for the successful implementation of a number of projects under the technical assistance of the EBRD, and for making a major contribution to the development of the financial sector in general. It was emphasized that trading fees and expenses of stock market participants had been reduced, market liquidity was improved, and favorable conditions had been created for domestic and foreign investors to participate in securities trading. The successful introduction of the ‘DvP/T+2 settlement mechanism and default risk management framework’ within the framework of the ‘Money and Capital Market Development Strategy for Mongolia’ technical cooperation (2018-2020) was also acknowledged.

The Government of Mongolia has successfully launched national programs to digitalize public services, to deliver public services with reduced bureaucracy, more transparency and improved accessibility. In this context, the Commission is working to implement a large-scale digital transition project, tailored to its specific needs; to deliver its activities to regulators, clients, and customers in a timely and open manner. The two parties discussed efforts in this area, and Mr Takacs stated that prioritizing active cooperation would continue.

Source: Financial Regulatory Commission

Ulaanbaatar

Ulaanbaatar