International Collaborations at a High Level: TDB's Partnerships with Prominent Organizations

The Mongol Messenger

Ulaanbaatar, May 19, 2023 /MONTSAME/. Domestic systemically important banks (DSIBs) of Mongolia commenced their initial public offering (IPO) successively, leading to their transformation into public companies. The Trade and Development Bank (TDB), the first bank of Mongolia, has announced its IPO, having attained authorization from the Bank of Mongolia, the Stock Exchange of Mongolia, and the Financial Regulatory Commission. O. Orkhon, the TDB Executive Director was interviewed pertaining to this matter.

-Greetings.

Firstly, I would like to congratulate to your esteemed colleagues who are on

the verge of launching the bank’s IPO, transforming into a publicly traded

company subsequent to obtaining official approval. It has become a prevailing

practice internationally for businesses to function as public company. In this

context, I am interested to inquire whether the transition of prominent

domestic commercial banks into publicly traded entities signifies a notable

advancement towards aligning Mongolian banks and financial institutions with

internationally recognized standards?

-Indeed, DSIBs are actively engaging in the issuance

of shares, thereby undertaking the transformative process of assuming the

status of public companies, which launches a new era in the banking and

financial market. Moreover, it represents a crucial stride in the advancement

of the stock market. TDB holds a venerable position in banking system of

Mongolia, boasting a distinguished history and extensive expertise. Upon reflection,

it is evident that our bank has made substantial contributions and played a

pivotal role in propelling the growth of Mongolia's economy, nurturing its

private sector, and fostering a conducive business environment. Looking ahead,

we will achieve DEVELOPMENT TOGETHER.

One of the

noticeable attestations of it is that our bank has secured the distinction of

being the foremost international bank and the largest institutional bank in

Mongolia's banking sector. To illustrate, I would like to cite a specific

example – in the year of 2022, our bank solely accounted for a considerable 43%

of all corporate loans extended in the banking sector. We have fostered

strategic partnerships with leading largest enterprises across various sectors

since their inception. Notably, 94 out of the TOP 100 enterprises affiliated

with the Mongolian National Chamber of Commerce and Industry (MNCCI) have

chosen our bank as their financial partner. The realization that such a

substantial institution operates as a public company confers numerous

advantages and opportunities.

-The entities holding the most significant

stakes in Mongolia's economy are the TOP100 enterprises as identified by MNCCI.

It is noteworthy that over 90 percent of these organizations are clients of

TDB. Does this substantial level of concentration, from a statistical

standpoint, evoke a sense of gravity or significance?

-It

is important to clarify that our bank's support is not limited exclusively to

large enterprises or organizations. Rather, we are committed to fostering the

growth and development of small and medium-sized businesses. In the year of

2022, a total of 494 clients classified as small and medium sized enterprises

became valued customers of the organization segment. Through this partnership,

these enterprises will have the opportunity to expand their operations and

capabilities. It is a common understanding that today's small and medium-sized

businesses have the potential to become large organization of tomorrow, and

their rise will have a significant impact on the economic prospects of

Mongolia.

Our institution

is committed to facilitating the growth and development of businesses, while

also serving as a financial conduit to international markets. By providing

support and resources for the expansion of businesses, we are working towards

the shared goal of achieving DEVELOPMENT TOGETHER. Our dedication to this

mission has earned us recognition from both our valued customers and esteemed

international partner organizations, distinguishing us as the premier

institutional bank in Mongolia, as well as the foremost international bank in

the country. This recognition is a testament to the tangible results of our

endeavors, and represents a significant competitive edge for TDB.

-In the context of a comparatively modest

stock market such as ours, is there a possibility that the issuance of shares

by major banks may lead to a depletion of the already limited capital in the

stock market, thereby causing risks in raising capital from public during the

IPO process?

-As you rightly mentioned, the topic of banks

transitioning into joint-stock companies has been under discussion for several

years, and it has been over two years since the amendment of the Banking Law.

Since the approval of these amendments, both domestic and foreign customers and

investors have expressed keen interest in investing in our bank. Notably,

investors from South Korea have expressed their intent to explore opportunities

within our shares. Therefore, I am confident that the fundraising aspect of the

IPO will not be a cause for concern.

Furthermore, it is crucial to highlight that

TDB has a commendable track record of successfully issuing bonds in the

international market and possesses substantial experience in operating within

the international capital market. Building upon this foundation, our intention

is to conduct the IPO in accordance with recognized international norms and

standards.

-I comprehend that there exists a notable

interest from both foreign and domestic investors, many of whom possess

extensive international experience, regarding the forthcoming IPO of TDB.

Given that we have touched upon the subject of bonds, I suggest we delve

further into this matter.

-As you are undoubtedly aware, TDB holds the

distinction of being the pioneer and sole commercial bank to have conducted

bond issuances in the international market. To date, we have successfully

issued five bonds, raising medium and long-term funding with total amount of

USD 1.14 billion, which was utilized to support the business activities of our

valued clientele. Notably, we have diligently honored our financial

obligations, including the complete repayment of the most recent USD 500

million bond in 2020. By leveraging both internal and external funding sources,

we are committed to providing essential financing to the prominent enterprises

that constitute a driving force within Mongolia's economy. Through fulfilling

this crucial responsibility, we continue to play an instrumental role in

fueling economic growth and development.

-Can we conclude that TDB's

accomplishments have significantly enhanced Mongolia's standing in the global

capital and banking financial markets? Furthermore, you mentioned that your

bank is regarded as the best international bank by your esteemed customers.

Could you elaborate on this?

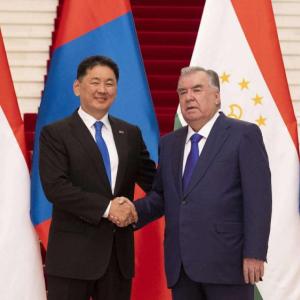

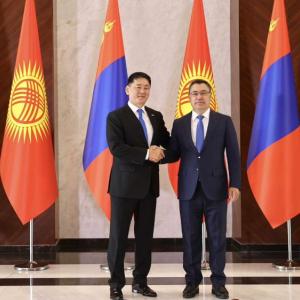

-Undoubtedly,

our intention is to foster extensive relations and collaboration with

international organizations operating within Mongolia.

Our primary objective is to provide unwavering

support to businesses. Noteworthy examples of this commitment include our

partnerships with prestigious entities such as the American and Australian

Chambers of Commerce and Industry. Strengthening these high-level mutual

relationships serves to enhance the business environment between the respective

countries, ultimately benefiting both the business community and Mongolia's

overall economy.

In addition, we engage in cooperation with over 300 inter nationally acclaimed banking and financial institutions. Our collaborations encompass various areas, including foreign settlement, trade finance, and numerous other domains. Remarkably, by the conclusion of 2022, our bank alone accounted for 32 percent of Mongolia's foreign payments and 27 percent of trade financing, underscoring the substantial impact of our operations within the international landscape.

-In light of the comprehensive

overview of TDB's past and current achievements, should we also address any

challenges encountered by the bank? Media reports have highlighted the

significant level of non-performing loans at TDB. Could you shed light on the

reasons behind this occurrence and the measures being implemented to address

it?

-Undoubtedly,

the past few years have witnessed weak economic activity and growth,

attributable to various factors such as the global impact of the Covid-19

pandemic, logistical challenges in transportation, and ongoing conflicts. The

resultant disruptions have adversely affected Mongolia's economy and

businesses, leading to a decreased demand for business loans and difficulties

in loan repayment. Naturally, these circumstances have impacted a bank of our

stature, responsible for 43 percent of corporate loans. However, we have

intensified our focus on ensuring loan repayment quality and have taken

appropriate measures to address the situation.

The banking sector holds a distinctive

position as it serves as a reflection of a country's macroeconomic conditions.

The global economy is currently fraught with uncertainty, characterized by

factors such as conflicts and inflation stemming from the repercussions of the

Covid-19 pandemic. Banks in the United States and Europe are beginning to face

challenges as a result. Nonetheless, the economic recovery and expansion of

China present a notable advantage for Mongolia and, in turn, TDB. China has not

only relaxed its "Zero Covid" policy but also plans to make

substantial investments in infrastructure to drive economic growth. This

development is expected to significantly boost mining and commodity exports,

thereby positively impacting commodity prices. We perceive this as a

significant growth opportunity for our bank, which actively supports major

projects, programs, and industries in Mongolia.

-To make investment decisions, investors often

consider the future growth prospects of a company. Could you elaborate on the

projected future growth for TDB?

-Currently, the

prices of key raw materials, which constitute a significant portion of our

country's GDP and export earnings, are at highly favorable levels. For

instance, the price of coking coal has reached USD 160-170 per ton this year,

with Erdenes Tawan Tolgoi Company reporting record production and export levels

at the end of last year and the first quarter of this year. Additionally, the

price of copper has surged beyond USD 8,000 per ton, while the price of gold

stands at USD 2,000 per ounce. These circumstances indicate favorable

conditions for a potential commodity super cycle, providing an opportune

environment for high economic growth in our country.

During periods

of robust economic growth, the income of companies and individuals tends to

rise, leading to an increase in bank resources. This, in turn, fuels a higher

demand for investment and credit financing, including business credit.

Consequently, the quality of loans and repayment improves, significantly

impacting the profitability of our institution-based bank. A noteworthy example

is the period of 20102014 when Mongolia experienced rapid economic growth.

During this time, TDB witnessed the highest growth in the sector across

indicators such as assets, equity, and net profit. In essence, the growth of a

bank is intricately linked to various macro factors, both on a global scale and

within Mongolia.

-Is it possible for investing

in bank stocks to completely mitigate risks, given the fact that all major

banks are included in the TOP-100 list of Mongolian companies based on their

commendable financial efficiency?

-Investors should be aware that investing

involves certain risks. Perhaps if you have deposited your money in a large

bank with a good financial record, the returns you will receive are clear.

However, the shares listed on the stock

exchange are freely traded on that exchange market, and anyone can buy and sell

them.

The price of a stock at any given time depends

on many factors. It is impossible to predict with certainty what the price will

be. In addition to the knowledge, experience and skills of the investors,

emotional factors can also move the market in the short term. Therefore, there

is always risk for investors.

-If I recall correctly, the idea that

investing in commercial bank stocks is a risk-free endeavor has persisted for a

considerable period. What are your thoughts on this?

-As you may recall, there was an instance last

year when oil prices plummeted to negative, which appeared illogical since

buyers were being paid to accept the oil. However, this was a result of various

factors that influenced the commodity market. Although this is a mere example,

commodities can be freely bought, sold, and traded, similar to the stock

market. As a result, individuals who partake in this market are reminded to

collaborate with professional organizations and teams, as well as undertake

risks that align with their risk tolerance levels.

Conversely,

while there are risks associated with investing in the stock market, there are

also potential rewards. Investors who purchase shares may receive returns in

two ways: firstly, through the appreciation of the stock price and secondly,

through the payment of dividends. Therefore, it is critical to conduct thorough

research on companies with real assets, legitimate business models, and strong

returns on investment. Selecting such investments can result in substantial

returns in the long run.

-What opportunities and advantages does TDB

offer to investors?

-TDB is dedicated to preserving its traditional advantages while concurrently pursuing a strategy to expand its presence in the retail banking market and the small and medium-sized banking market. With this approach, we possess the potential to achieve long-term growth and generate favorable returns for investors. To realize these mid-term strategic goals, we have identified and implemented several initiatives. Since 2020, our focus has been on becoming a

- customer-centric bank,

- a platform bank,

- an international bank.

We are diligently executing various tasks in a

step-by-step manner to progress towards these objectives. As a testament to our

efforts, we have witnessed tangible outcomes. For instance, the introduction of

the Britto card has led to a notable increase in our market share of Visa

cards, rising from 14 percent to 25 percent in 2022. Moreover, through the “Mongolia

with Savings” campaign, more than 43,000 individuals have opened new savings

accounts in 2022, marking a five-fold increase compared to previous years.

Furthermore, we

have developed and implemented a new business strategy, structure, and model.

Substantial investments have been allocated to enhance our e-migration

capabilities and technology infrastructure. By integrating world-leading

systems that streamline internal processes, reduce costs, and leverage

artificial intelligence for informed decision-making, we aim to further elevate

our operational efficiency and deliver superior customer experiences.

-What will the funds raised through the IPO be

utilized for?

-One of our

bank's key medium-term strategic objectives is to establish ourselves as a Green

Bank. The funds obtained through the IPO will serve as a valuable source of

green and sustainable financing. We will focus on supporting both large

enterprises and small and medium-sized businesses, with particular emphasis on

empowering women entrepreneurs. These funds will be directed towards financing

energy-efficient products and services, promoting low-carbon transportation,

facilitating the development of green buildings, and enabling the construction

of affordable housing for citizens.

TDB has been a

pioneer in introducing the concept of sustainable financing within Mongolia's

financial system since 2012. We established the Mongolian Sustainable Financing

Association and have made significant progress in this domain, setting industry

standards. Additionally, we have obtained accreditation as an organization of

the Green Climate Fund, an initiative under the United Nations. This

accreditation provides us with opportunities to implement various projects and

programs. In collaboration with the government and private sector clients, we

are currently developing proposals for projects and programs financed by the

fund. These initiatives encompass large-scale national projects focused on

energy conservation, renewable energy, food security, agriculture, and regional

green development. The funds raised from the IPO will serve as substantial

support for the expansion and intensification of these activities, allowing us

to make a significant contribution to sustainable development in Mongolia.

-That sounds highly promising, particularly

considering the global shift towards sustainability. With that in mind, I would

like to leave the final question open for you.

-As TDB transforms into a joint-stock company,

we anticipate enhanced governance and control mechanisms. Simultaneously, our

equity will increase, enabling us to expand our operations further. As a

result, we will continue to DEVELOP TOGETHER with each of our valued customers,

fostering mutual development.

-Thank you for dedicating your time to this

conversation. We have engaged in a fruitful discussion encompassing topics such

as the Mongolian and global economy, banking, and capital markets. I extend my

best wishes for the successful endeavors in making TDB a publicly traded

institution.

Ulaanbaatar

Ulaanbaatar