“S&P” Upgrades Mongolia's Credit Rating to "B+"

Economy

Ulaanbaatar, October 9, 2024 /MONTSAME/. The Ministry of Finance of Mongolia announced on October 4, 2024, that the “S&P” international agency upgraded Mongolia’s credit rating to “B+ Outlook positive.”

The Fitch Ratings international agency upgraded Mongolia’s credit rating to “B+” two weeks ago, announcing that the upgrade was due to the country’s reduced debt burden, improved fiscal discipline, consistent increase of foreign currency reserves, and political stability.

On October 4, 2024, the “S&P” international agency upgraded Mongolia’s credit rating to “B+.” Thus, two out of the three credit rating issuing agencies, which are “Fitch Ratings,” “S&P,” and “Moody’s,” have elevated Mongolia’s credit rating to “B+.”

With the upgraded credit rating, foreign investors would be more confident investing in Mongolia and the foundation for direct foreign investment will be strengthened, signaling further improvement to the credit rating of the country, reported the Ministry of Finance of Mongolia.

According to the report by “S&P” regarding the upgraded credit rating,

Mongolia's economy has outperformed our earlier expectations. We now view its trend growth to be significantly stronger than that of peers of similar income levels.

We estimate the economy will expand a strong 6% in 2024, fueled by coal and copper exports, boosting government revenues.

In addition, we expect export growth to sustain, supporting current account receipts, which may lift external metrics.

We therefore raised our long-term sovereign credit rating on Mongolia to 'B+' from 'B' and affirmed our 'B' short-term rating. The outlook on the long-term rating is positive.

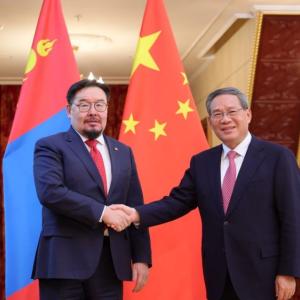

We expect Mongolia's economy to maintain strong growth in 2024, with support from surging exports following the removal of border restrictions and smoother passage of coal to China.

Economic prospects over the next two to three years are likely to outpace sovereign peers' and will continue to be propelled by strong foreign direct investments in mining.

We believe political stability following the general elections in June should facilitate constructive policymaking.

Ulaanbaatar

Ulaanbaatar