IMF: Mongolia Needs to Adopt Greater Fiscal Prudence and Enhance Exchange Rate Flexibility to Counter Mounting Trade Tensions

Economy

Ulaanbaatar, May 21, 2025 /MONTSAME/. The Mongol Messenger Newspaper of the MONTSAME National News Agency of Mongolia presents an op-ed written by International Monetary Fund Resident Representative for Mongolia Tigran Poghosyan.

Asia’s Outlook Dims Amid

Trade Tensions

US tariffs have reached

their highest levels in a century, with many of the steepest aimed at Asia. The

region, which contributed nearly 60% of global growth in 2024, is now seeing

its trade-led development model tested. Long reliant on liberalized trade and

deep integration into global value chains, Asia faces mounting challenges as

US-China tensions escalate and global trade policy becomes increasingly uncertain.

While some tariffs have been paused, the overall climate of protectionism and

weaker global demand is weighing heavily on regional prospects.

Against this backdrop,

the economic outlook for Asia and the

Pacific has

dimmed significantly. Regional growth is forecast to slow to 3.9% in 2025, down

from 4.6% in 2024—the sharpest downgrade since the pandemic. Advanced Asian

economies are projected to grow by just 1.2%, while growth in emerging and

developing Asia is expected to reach 4.5%, both reflecting downward revisions.

China’s growth is set to remain around 4% despite fiscal stimulus, and ASEAN

economies are particularly exposed, with growth downgraded to 4.1% amid

external shocks and soft domestic demand. India, less reliant on trade, is

expected to slow moderately but remain a relative outperformer.

Tariffs and rising trade

barriers threaten to dent the region’s post-pandemic momentum, especially as

many Asian economies depend on exports amid subdued domestic demand. High debt

burdens and rising borrowing costs have also curbed consumer spending in several

countries. While demand for high-tech exports—especially those linked to AI—has

supported trade with the US and other advanced economies, this has also

increased Asia’s vulnerability to shifts in US demand and the risks of

intensifying protectionism.

Mongolia’s Economy Will

Feel the Impact

While Mongolia is not

directly involved in the ongoing tariff wars, it remains highly vulnerable to

the ripple effects of escalating global trade tensions—particularly those

between the United States and China. As China absorbs over 90 percent of

Mongolia’s exports, mostly in minerals like coal and copper, any slowdown in

Chinese demand due to tariffs or weakened industrial activity poses a direct

threat to Mongolia’s economic growth and budget. Lower commodity prices, driven

by heightened global uncertainty, could further erode national income, reduce

government revenue, and widen external imbalances.

The growing uncertainty

in global markets is likely to dampen investor confidence, especially in small,

resource-dependent economies such as Mongolia. Weaker foreign investment would

hinder progress on critical infrastructure, mining, and diversification

projects—many of which are central to the coalition government’s development

agenda. A decline in both export earnings and capital inflows would strain

Mongolia’s external accounts and weigh heavily on its financial resilience.

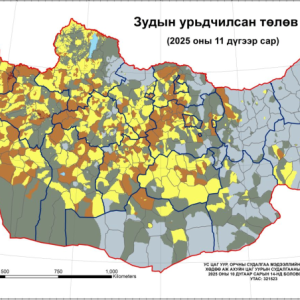

These pressures are

already felt through the exchange rate. Reduced foreign currency inflows have weakened

the tugrik, raising the cost of imports such as fuel, machinery, and consumer

goods. Mongolia could face rising inflation, eroding household purchasing power

and forcing the central bank to tighten monetary policy further. In turn,

higher interest rates could dampen domestic demand, compounding the economic

slowdown.

Balancing Act for Policies

to Counter the Vicious Cycle

The policy priority is to

restore both external and internal balances and avoid a rapid erosion of policy

buffers to prepare for future shocks.

Greater fiscal prudence and adherence

to fiscal rules are needed. To avoid buffers from eroding and external

imbalances from widening, the government should restrain demand for imports by containing current

spending and strengthening collections of non-mining tax revenues. The planned

cuts to non-mining taxation need to be reconsidered. The government needs to proceed

cautiously on mega projects given existing weaknesses in public investment

management and constraints in absorption capacity.

With rising inflation and credit

growth, the BOM needs to maintain tight domestic financial conditions. A

further increase in the policy rate is warranted to contain inflation and

manage inflation expectations, while reserve requirements should aim to manage

liquidity. The debt service-to-income limits of the non-bank financial sector

should be harmonized with those of the banking sector to contain excessive

growth in consumer credit and reduce regulatory arbitrage.

Amendments to the central bank law,

including recapitalization plans, are critical to boost the BOM's operational

independence, thus its effectiveness and credibility.

Finally, greater exchange rate

flexibility would strengthen resilience against external shocks.

Ulaanbaatar

Ulaanbaatar