Ebarimt System to Be Fully Digitalized

Economy

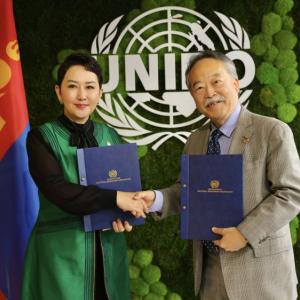

Ulaanbaatar, August 6, 2025 /MONTSAME/. Minister of Digital Development, Innovation, and Communications Batshugar Enkhbayar held a meeting with representatives of relevant institutions within the framework of the full digitalization of the “Ebarimt” system.

Deputy Governor of the Bank of Mongolia Enkhtaivan Ganbold, Director General of the Payment Systems Department of the Bank of Mongolia Anar Enkhbold, Deputy Director of the General Department of Taxation of Mongolia Enkhbold Amjaa, Director of the Information Technology Center of Finance Batbileg Tumur, and other officials from the Tax Authority attended the meeting. Participants underscored that paper-based Ebarimt receipts can be fully phased out in favor of a digital system.

Currently, electronic receipts are automatically registered through the “CU Mongolia” mobile application. Khan Bank has directly integrated its internal services with the Ebarimt system, while companies such as Mobicom and Unitel have also linked their services to the automated registration system. Following this model, efforts have now commenced to ensure that purchases made with citizens’ bank cards are automatically registered in the Ebarimt system.

Minister of Digital Development, Innovation, and Communications E. Batshugar stated, “As part of Prime Minister of Mongolia Zandanshatar Gombojav’s initiative to increase Ebarimt cashback returns from 2 percent to 5 percent, we are launching a project to simplify and fully digitalize the registration of Ebarimt receipts. This effort will be a key component of Mongolia’s digital transition.”

Deputy Governor of the Bank of Mongolia G. Enkhtaivan noted that, “Currently, receipts issued to business entities are registered automatically. For individuals, it is technically possible to register receipts using the national ID number associated with the citizens' bank accounts. However, users will need to select which account to link. Collaboration with banks will be essential to develop this functionality through mobile apps.”

Director of the Information Technology Center of Finance Batbileg Tumur added, “The system already receives data from point-of-sale systems and transmits it to the tax authority. To include commercial bank transactions, support from the Bank of Mongolia will be required. On the user side, individuals will need to select their preferred card. There are no major technical barriers to implementation, but security and privacy must be ensured.”

Once the service is fully digitalized, it is expected to create favorable conditions for citizens to receive their full tax cashback entitlements.

Ulaanbaatar

Ulaanbaatar