FTSE Russell approves to add the stock market of Mongolia in 'Frontier market' classification

Economy

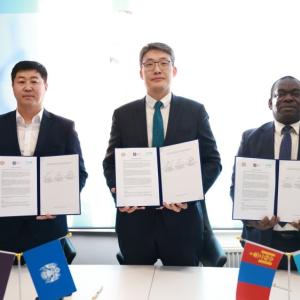

Ulaanbaatar /MONTSAME/. On September 29, the FTSE Russell Group, a subsidiary of London Stock Exchange Group (LSEG), sent an official letter to Kh. Altai, the Chief Executive Director of the Mongolian Stock Exchange, about confirming the stock market of Mongolia in the 'Frontier Market' classification.

According to the FTSE RUSSELL, the stock market of Mongolia has fully met the criteria for FTSE Russell's 'Frontier Market' classification and will be added in this classification from the September, 2023.

Mongolia was first placed on the 'Frontier Markets Watch List' classification of

FTSE Russell in 2012. But, in 2017,

Mongolia was removed from the 'Watch List' without added in Emerging Market Countries

due to reasons such as failure to meet regulatory standards for the Mongolia

Stock exchange (MSE) and a lack of

global custodians in country.

Since then, the Mongolian stock exchange cooperated with the Financial Regulatory Commission and other infrastructure organizations in order to bring the domestic capital market to international market status. Thus, in September 2021, FTSE Russell officially re-added Mongolia in the 'Watch List' of the 'Frontier market' classification.

The Mongolian Stock Exchange reported that the international recognition of our country's stock market is important for attracting international investment, increasing market trading activity and liquidity, and accelerating development.

The subsidiary classifies international markets into 4 main

levels from 'Developing' to 'Highly Developed' based on a

number of technical criteria set by professional investors. As of September

2022, 29 countries, including Bulgaria, Estonia, Kazakhstan, Latvia, Lithuania,

and Vietnam, are included in the 'Emerging Market' category.

Ulaanbaatar

Ulaanbaatar