Second Phase of the IFC Green Finance Market Development Project Launches

Economy

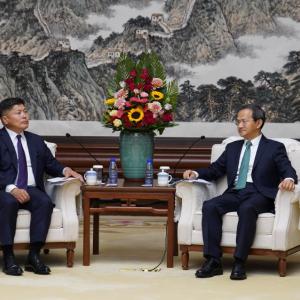

Ulaanbaatar, June 6, 2025 /MONTSAME/. The Financial Regulatory Commission of Mongolia and the International Finance Corporation (IFC) have renewed their partnership to further advance sustainable finance in Mongolia by signing a new Memorandum of Understanding. The signing of the cooperation document also marks the launch of the second phase of the IFC Green Finance Market Development Project.

Under the Memorandum of Understanding, the two parties will focus on developing regulations for innovative thematic financial instruments, including blue bonds, sustainability-linked bonds, and sustainable bonds. They will also work to align Mongolia’s Environmental, Social, and Governance reporting framework with the International Financial Reporting Standards’ Sustainability Standards 1 and 2.

Chairman of the Financial Regulatory Commission Jambaajamts Tundev said, “This initiative aims at supporting more Mongolian issuers in tapping into climate-themed finance beyond green bonds, diversifying their funding sources, and attracting additional capital for key projects. By collaborating with IFC, we can help build a more resilient and environmentally sustainable financial sector that aligns with international standards. This will contribute to the overall sustainability of our economy.”

Mongolia has made significant progress in promoting green

finance through various initiatives. In

2021, with support from the Government of Japan through its

Comprehensive Trust Fund, IFC assisted the FRC in formulating Mongolia's Green

Bond Regulation and Guideline documents. Since then, seven corporate green and social bond transactions have

been successfully issued in both local and international markets, raising a

total of $338 million. In 2022,

IFC collaborated with other development partners to support FRC in launching

the Environmental, Social, and Governance (ESG) and Sustainability Reporting

Guidance for Mongolian companies, referencing leading international reporting

frameworks, as well as the IFC Disclosure and Transparency Toolkit. In 2023,

FRC joined the IFC-supported Sustainable Banking and Finance Network.

Under the initial phase of the "IFC Green Finance Market

Development" Project, IFC conducted a comprehensive climate risk exposure

assessment for the Mongolian banking sector. In

2023 and 2024, IFC invested in

Mongolia’s first green bond and social bond, respectively, helping to catalyze

the country’s sustainable bond market.

Ulaanbaatar

Ulaanbaatar