Central bank reports on current financial situation

Economy

Ulaanbaatar /MONTSAME/. On November 28, the Bank of Mongolia delivered a report on timely issues concerning the economy of Mongolia.

As of October, 2019, money supply reached MNT 20.5 trillion, showing growth by 11.7 percent compared to the same period of last year and the money supply is mainly composed of savings of tugrug, current accounts and savings of foreign currencies.

Compared to last year, the credit increase became 10.6 percent, reaching MNT 18 trillion and 87.8 percent of the total credits is Tugrug loans and 12.2 percent is foreign currency loans. Overdue loans and outstanding loan each accounted for around 10.7 percent in the total amount of loans. It also has been reported that the annual interest rate of credit issued by commercial banks was around 16.8 percent and foreign currency loan rate was 8.9 percent.

Officials from the central bank, during the meeting, informed that there will be no large amount of due payment by the Government of Mongolia and the central bank besides payment of a swap agreement established with the People's Bank of China, which was extended in November 2018 by three years. Moreover, it is expected that a pleasant condition will be created thanks to the anticipating IPO of Tavantolgoi deposit. The recently-adopted Parliamentary resolution on ensuring the interests of Mongolia in the exploitation of Oyu Tolgoi deposit will eliminate uncertainty posed in the project.

The remaining balance of securities held by the Bank of Mongolia amounted to MNT 4.2 trillion as of yesterday, November 28. The growth in the balance is brought about by the government’s decision not to issue securities in domestic markets and the increase of currency flow inbound to Mongolia in recent years. Such measure to grow the securities balance by the central bank is designed for preventing from economic risks.

To date, the central bank has purchased a total of 14 tons of gold, which was decreased by 4.2 tons compared to last November equaling 18.2 tons of gold. The drop in gold-buying is influenced by several factors, such as the mineral royalty rate growth and government measures to shut down illegal mines.

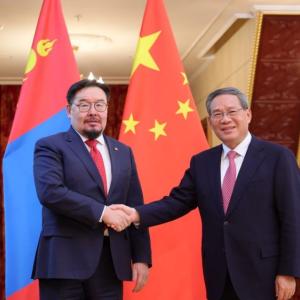

Regarding the recent appointment of the new Governor of the Bank of Mongolia, the officials of the central bank confirmed that the bank will continue to abide by the general directions it has been following in the past three years, aimed at sustaining the economic revival, ensuring stable currency rate of tugrug. During the tenure of the new President of the central bank, some works requiring considerable efforts are awaiting the bank, including the successful implementation of the Extended Fund Facility, which will terminate in May 2020, Mongolia’s target to get out of Grey List of the Financial Action Task Force (FATF) and works to renew the swap agreement with China, which is to end in July 2020.

Ulaanbaatar

Ulaanbaatar