Parliament adopts amendments to Banking Law

Economy

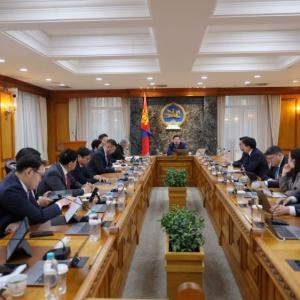

Ulaanbaatar /MONTSAME/. At its plenary session held on January 28, 2021, State Great Khural, parliament of Mongolia, approved amendments to the Banking Law of Mongolia. 90.9 percent of 55 members present at the meeting of the parliament’s autumn session voted in favor of the changes to the Banking Law.

Amendments to several laws, including the Law on Savings at Banks, Law on Central Bank, Banking Sector Stability Law and other regulations that accompany the amendments to the Banking Law were also approved at the parliament meeting.

Effective implementation of the latest amendments to the Banking Law will result in reducing the bank ownership concentration and ensure balance of ownership-management-control in the banking structure.

Risks associated with concentration on shareholders and executive management are expected to lower thanks to the amendments, and enhance public control and independence of banking supervision, bring more transparency and accountability with the help of public ownership in the banks.

In Mongolia, commercial banks’ ownership concentration is viewed as too high because up to 3 shareholders own more than 90 percent of total shares in commercial banks in the country. By the end of November 2020, total assets of the Mongolian banking sector were estimated at MNT 35.8 trillion and around 90 percent of them are public and over 10 percent are owned by bank shareholders, entailing the improvement of governance in the banking sector and strengthening of banks’ transparency.

According to the Bank of Mongolia - the central bank, the following four main principles were abided when developing amendments to the Banking Law:

- Banks will be made publicly traded. There are a total of 12 banks operating within the country’s banking sector and 5 of them are considered as systemically influential or important. In compliance with the amendments, the five influential banks will have to transform into a public company through an initial public offering on stock market before June 30, 2022. Other banks can go public or remain as privately held company at their own discretion.

- Ownership concentration will be reduced. The revised law allows each shareholder and their associates to own not more than 20 percent of total shares issued by a commercial bank. All banks in the country must fulfil this obligation before December 31, 2023.

- The law amendments also provide provisions to make sure that the order for debt settlement are better delineated and the rights of bank customers are protected when banks go into liquidation. Citizens and household families who are deposit account holders in a liquidated bank get first priority to receive their money before the legal entities.

- Characterizations of influential banks in the banking system are described in more details in the revised law. As per the Banking Sector Stability Law, an influential bank is defined as a bank which accounts for more than 5 percent in the total banking system in terms of assets. Now, the amendments rule that the banks’ influence is determined on the basis of their assets, their percentage in the transaction flow in the payment system, core activities, the state of their relevance, the number of their customers and other features, instead of their share in the banking system only.

As the banks now stand in need to be listed on stock market, more complex criteria will be laid down on their transparency, capital and earnings as well as corporate governance to conform to the revised Banking Law, reports the central bank.

Ulaanbaatar

Ulaanbaatar