Bell-ringing Ceremony Held to Issue IPO of MSE

Economy

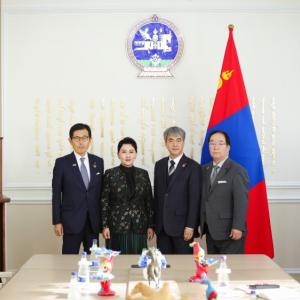

Ulaanbaatar /MONTSAME/. The bell-ringing ceremony to issue the IPO of the Mongolian Stock Exchange (MSE) state-owned company was held today, December 26, 2022. Minister of Finance B. Javkhlan rang the bell and Chairman of the Financial Regulatory Committee Mongolia D. Bayarsaikhan, Head of the Government Agency for Policy Coordination on State property B. Tsengel, CEO of the MSE Kh. Altai and other officials attended the ceremony.

Emphasizing the MSE, fully state-owned since its inception in 1991, has been playing an important role in the history of the Mongolian financial sector over the past 30 years, B. Javkhlan, Member of the State Great Khural (Parliament) and Minister of Finance, stressed that a new historical era is coming with the development of the most optimal and bold model for the next ten years.

"In order to create the basic economic conditions and successfully implement the strategic development policies, the State Great Khural and the Government approved the the "Vision-2050”, long-term development policy of Mongolia. Thus, the creation of transparent and efficient companies with disciplined financial governance through public control and the work of reducing the state's share and participation by offering shares of state-owned enterprises to the public is being organized step by step.

B. Javkhlan: By trading the Mongolian Stock Exchange shares, public participation and control will increase in the market.

"We have

successfully made the first step towards achieving our long-term development goal.

The parliament made a policy decision that will have a great positive impact on

the development and prosperity of Mongolia. This is the State Great Khural

Resolution No. 16 to make a total of 25 state-owned companies and state-owned

banks public within 2022-2023.” said B. Javkhlan.

During the bell-ringing ceremony, Kh. Altai, CEO of the Mongolian Stock Exchange said, "According to the law on state and local ownership, a person and his/her related parties cannot own more than 5 percent of the company when it changes from state-owned to public. Also, citizens with political affiliations cannot own shares. So, the Mongolian Stock Exchange is free from any political influence and there is no risk that any company will own its shares. This means that in the real sense, it is the beginning of the transition to public control. This is a major event in that the MSE meets international standards.”

Mr. D. Bayarsaikhan (Chairman of FRC Mongolia) indicated that "2022 was a productive year full of achievements for the capital market of Mongolia. In particular, the Banking Reform is being implemented successfully within the framework of the Amendments to the Banking Law. Systemically important banks including the State Bank and the Golomt Bank issued IPOs and raised MNT144.2 billion. The State Bank became the first open joint-stock company among systemically important banks, and its trade order exceeded 100% on the first day the stock was offered. Another important event that happened in the capital market this year is the 'Mainstream for the public trading of shares of state-owned legal entities in 2022-2023 through the exchange' approved by the Parliament."

"Accordingly, the MSE is planning to raise MNT11.9 billion by offering 34% of its shares to the public. In the meantime, the development of the Mongolian capital market began with the privatization of state property more than 30 years ago, and Mongolia shifted from a centrally planned economy to a free economy. The past 30 years have been a combination of successes and failures, and a constantly growing capital market with a value of MNT6.7 trillion was created. Privatization of state-owned companies not only improves the organization's efficiency, competitiveness, and governance but also promotes the national economy and financial market."

Finally, Mr. D. Bayarsaikhan highlighted that the FRC will pay attention to developing a multi-pillar and inclusive financial market promoting sustainable development.

Ulaanbaatar

Ulaanbaatar