Draft Law on Amendments to the Law on Credit Information Submitted to the State Great Khural

Politics

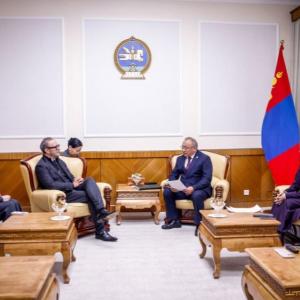

Ulaanbaatar, December 25, 2024 /MONTSAME/. On December 25, 2024, Member of the Parliament of Mongolia Batshugar Enkhbayar submitted a Draft Amendment to the Law on Credit Information and a pertinent Draft Resolution to Chairman of the State Great Khural of Mongolia Amarbayasgalan Dashzegve. Banking and financial products and services should be aligned with economic growth, demographic structure, and the scope of business operations and should be based on big data, digital information, and the credit information database. In Mongolia, there is no regulation that mandates the approval of creditworthiness assessments by authorized entities. However, the authorization of assigning credit ratings to borrowers by relevant institutions will create an opportunity to implement banking and financial services based on creditworthiness evaluations, emphasized MP Batshugar Enkhbayar. MP Batshugar also highlighted that the adoption of the Draft Law on Amendments to the Law on Credit Information will increase the accessibility of banking and financial services, improve risk assessments, and enhance management practices. In addition, lenders will be enabled to make risk-free and timely decisions, leading to a reduction in overdue and non-performing loans in the banking and financial sectors. On the other hand, borrowers will be able to monitor their credit history, increase financial discipline, and, as a result, reduce loan interest rates.

Ulaanbaatar

Ulaanbaatar