S.Erdene reports about law on future pension and mortgage loan interest

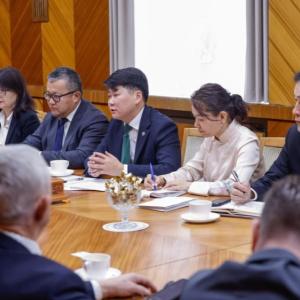

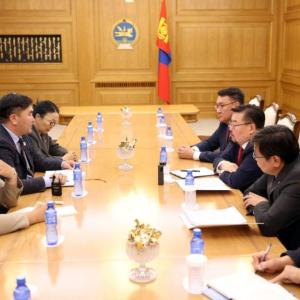

PoliticsUlaanbaatar /MONTSAME/ The Minister of Population Development and Social Welfare S.Erdene delivered a report at the “Hour of Minister” weekly meeting, on Thursday about the newly-adopted law on the "Future" pension fund and an altered interest of mortgage loan program.

The first law aims to create a fund that finances money for future pension expenses, to finance individuals’ accounts of pension insurance, to correlate it with the financial and investment markets, and to ensure a social guarantee for elders. By adopting it, country has laid a basis for a concrete accumulation of money for individuals’ accounts of pension insurance and for transmitting into a system of semi- and full-accumulation of pensions, the Minister said.

He said the pension insurance fund accumulated last week 3 trillion Togrog, which is about 30% of a sum to be placed in the funds of social insurance and pension insurance.

Implemented by the government of Mongolia, the national program on mortgage has been one of the most fruitful works done in the last three years. Thanks to a successful implementation of the program, some 77 thousand families have received apartments nationwide, Erdene said. In order to exploit money for continuing this program, a cooperation contract was concluded on Thursday between the Bank of Mongolia (BoM) and commercial banks, according to which the mortgage loans will be financed from accounts of the insurance fund of people. It had been financed by capitals from mortgage loan program’s budget, the Minister explained.

“Apart from the mortgage loans, the pension insurance fund could become a main source for other beneficial programs. From 2030, the pension fund is expected to be a vital source of pension,” he underlined.

The Minister pointed out that the mortgage loan interest has been reduced to five percent from eight percent, therefore the program will be realized in two phases. In the first turn, residents of re-planned areas and of0 remote districts of Ulaanbaatar and all provinces will be involved in the program. Next time, those who are already in mortgage loans with eight percent or new applicants could be involved in the mortgage programme, he said.

Ulaanbaatar

Ulaanbaatar