Blacklist System Abolished: Mongolia Introduces Credit Scoring

Economy

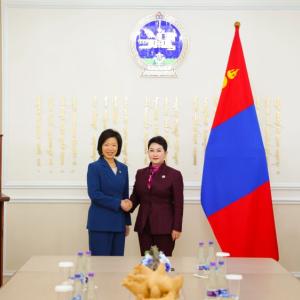

Ulaanbaatar, September 2, 2025 /MONTSAME/. Minister of Digital Development, Innovation, and Communications Batshugar Enkhbayar, together with relevant officials, announced that the banking blacklist system has been abolished, following the enforcement of amendments to the Law on Credit Information, which commenced on September 1, 2025.

At the press briefing, the minister emphasized that the old blacklist system has been replaced with a credit scoring system. Previously, individuals listed on the blacklist were barred from obtaining loans for six years, even after fully repaying their debts. Under the new framework, credit information providers must update their operations by September 15, 2025.

Citizens will now be assessed by credit scores, starting from a baseline of 511 points, which indicates financial solvency. The scores will range up to 999, with the national average estimated at 650. Higher scores will give borrowers access to lower interest rates and more favorable financial services. Negative repayment history will lower scores initially, but can improve over time.

Minister Batshugar stated, “In May 2025, I initiated the amendments to the Law on Credit Information, which were subsequently adopted by the Great State Khural. Accordingly, today, the Governor of the Bank of Mongolia issued an order nullifying the blacklists of both businesses and individuals in commercial banks. This order applies to all institutions that provide data to the credit information system. As a result, around 70,000 individuals and entities have been removed from the blacklist. With the new system, borrowers who repay their loans on time will be rewarded with higher scores, allowing them to access financial services under more favorable conditions.”

As of 2025, the credit information system includes data from 12 banks, 436 non-bank financial institutions, telecommunication companies, state funds under ministries and agencies, savings and credit cooperatives, and other entities. As of 2025, it holds records of 1.6 million individuals and 19,600 enterprises.

The Great State Khural received the draft amendments to the Law on Credit Information on December 24, 2024.

Ulaanbaatar

Ulaanbaatar