Economy

Economy | Economy

Mongolia has taken a rapid, very positive development and been a stable democratic state for over twenty years. The country has made great progress in its transition to a market-based system since 1990. Until then, the economy was based on the strict centrally-planned model adopted almost sixty years earlier. The government launched a series of reforms from 1991, which included a phased liberalization of state controlled prices and tariffs; privatization of state-owned enterprises; and establishment of a two-tier banking system.

All sectors of the Mongolian economy are open to foreign investors and foreign investment is protected from nationalization and expropriation. The country is developing policies on responsible mining, renewable energy and ecotourism that place it on a green development path.

National Development Comprehensive Policy and Government Action Plan for 2012-2016, ensure economic growth, decrease inflation, support the policy on budget stability, and balance with appropriate investment and debt management policy, decrease unemployment by means of increasing employment, support growth of the real sector and intensify other activities respectively. A policy will be implemented in 2016 to ensure economic stability, increase GDP per capita and hold the inflation rate at one digit. The draft reflects that the unemployment rate is to be lowered to 7 percent, the percentage of the master budget expenditures in the GDP is to be made at 28.6 percent, and the loss of total equilibrated balance will be no lower than 4 percent.

On November 29, 2012, Mongolia’s government issued ‘Chinggis’ bonds worth USD1.5 billion, which consists of five year-bonds worth USD500 million with 4.125 percent and ten year bonds worth USD1 billion with 5.125 percent interest and sold them at the international financial market. The source of the bonds came to the government’s account at the Mongol Bank on December 5 of that year. Interest payments of the bonds have to be paid every year and the principal must be paid in 2018 and 2022. Then, the DBM’s 30 billion Yen and 10-year term ‘Samurai’ bonds were sold on December 26, 2013 at the Japanese financial market and money from the bond was accumulated at the DBM’s account on January 6, 2014.

Due to the Development Bank of Mongolia’s USD 580 million Euro bonds which matured on March 21, the Ministry of Finance announced that Development Bank-owned Eurobond is to be replaced by a new bond issued by the Government of Mongolia in February, 2017. Credit Suisse and J.P.Morgan will be acting as the bond’s underwriters.

In March of 2012, the Government of Mongolia launched USD 580 million worth of bond, “Eurobond” that was matured on March 21, 2017 with an annual interest rate of 5.75 percent. In order to build railroads and fifth power station, 36 percent of Eurobond was traded to European investors, 32 percent to American investors and 32 percent to Asian investors.

And thus, the Government of Mongolia launched the new bond costing USD 600 million with 7.625 percent interest rate in the first week of March. Reports indicate that the new bond will make interest payments every six months, which is approximately USD 26 million.

It is estimated that the actual economic growth of Mongolia in late 2015 was 2.3 percent according to the Asian Development Bank of Mongolia. Mongolia recorded some economic progress in 2015, narrowing its current account deficit (CAD) from 11.7% to an estimated 5% of GDP, according to the World Bank, in part due to lower imports and tighter monetary policy. Inflation also slowed during the year on the back of weaker domestic demand. By October, 2015, the rate of inflation had dropped to 3.4%, down from double-digit figures in late 2013.

On January 1, 2015, the Budget Transparency Law ‘Glass Account Act’ came into effect. The Budget Transparency Law, approved by the Parliament in July, 2014, constitutes one of the fundamental legal mechanisms to institute a Smart Government in Mongolia. The overall objective of the law is to establish an information system for transparent, open and comprehensive process of decision making and activities for budget governance and public oversight in order to effectively manage the state and local budgets as well as state and local properties or assets.

At the end of 2015, the Government of Mongolia passed a law on Economic Transparency in favor of its purpose to make the economy more open, properly controlled, and registered. As a result of the law, a total of Tgs 8 trillion in tax income and properties were disclosed.

Within the revised Law on Value-Added Tax (VAT), the Government of Mongolia has been implementing a VAT refund system starting from January 1, 2016 in hopes of a healthy economy. In conjunction with the revised law, people are entitled to take back 20 percent VAT (2 percent of all purchases) on every purchase they made, and participate in the monthly lottery with a total prize of Tgs 100 million.

In the last 20 years, the country was unable to create accumulations sufficient for overcoming economic risks, implement cyclic budget policy, or increase the amount of imports because it failed make economic structure changes. Thus, the Mongolian economy became dependent on mining by about 90 percent and the frequency of payment balance difficulties increased. On average for the last 5 years, 90 percent of export income and 80 percent of direct foreign investment was dependent on the mining sector. In this regard, it was reflected in Parliament Resolution that the country will carry out policy on making the economy a multi-pillared structure.

Mongolia, China and Russia are preparing to establish an Economic Corridor between the three countries. Since the heads of the three states held a historic meeting in 2014 for the first time, a series of meetings have been held at the Road and Transportation Ministers and Deputy Ministers and working groups’ level between the countries to talk about ways to broaden trilateral economic cooperation. During the second meeting, the heads of states agreed to set up an Economic Corridor connecting the Silk Road of China, Steppe Road of Mongolia. The program was in June 2014 during an annual Shanghai Cooperation Organization meeting in Tashkent, Uzbekistan.The first tripartite experts' meeting on the implementation of a program to establish Economic Corridor of Mongolia, China and Russia took place on March 24 in Beijing, China. The participants of the meeting discussed about measures and principles to carry out the program to establish Economic corridor. The meeting culminated in an establishment of a protocol on further measures and issues touched on this meeting on in the scope of the Economic corridor program.

The Government of Mongolia and Bank of Mongolia have reached a staff-level agreement with the International Monetary Fund on three-year Extended Fund Facility (EFF) program for USD 440 million.

On May 24, the Executive Board of the International Monetary Fund (IMF)approved a three-year extended arrangement under Extended Fund Facility (EFF) for Mongolia in a total amount of about USD 434.3 million to support the country’s economic reform program.

Other financing partners, including the Asian Development Bank, the World Bank, Japan, and South Korea have also committed to provide budgetary and project support, and the People’s Bank of China has agreed to extend its swap line with the Bank of Mongolia. In sum, the total financing package amounts to about USD 5.5 billion. The Board’s approval of the arrangement enables the immediate disbursement of an amount equivalent to about USD 38.6 million, which was disbursed into the central bank on May 25.

Several arrangements are to be made in the scope of the program, including 6some -7 tax rates are projected to increase and the government has consented to raise the retirement age in the long run and cut some duplicated welfare of social welfare. Amendments to the 2017 state budget, which will have those changes in the economic and financial due to the IMF’s Extended Fund Facility program.

Previously, the latest IMF intervention in Mongolia was a Standby Arrangement with USD 240.9 million exercised for six months starting April 1,2009.

The authorities’ adjustment and structural reform program, supported by the large package of external financing, is expected to stabilize the economy and lay the basis for sustainable, inclusive, long-run growth. By 2019, growth is projected to pick up to around 8 percent, as economic and financial conditions improve and key mining projects take off. Foreign exchange reserves should rise to $3.8 billion (above 6 months of imports) by the end of the program, similar to levels seen in 2012, before Mongolia was hit by external shocks. Fiscal consolidation will leave room for the banking sector, over time, to extend more credit to the private sector, consistent with projected growth. These policies would also put public debt on a declining path over the course of the program.

Foreign trade

Since the start of the transition to a market economy, Mongolia has been encouraging foreign trade and investment. Supported by donor countries and international organizations, Mongolia is finding its place in the international arena as it changes its economic system. Compared to other transitional countries, Mongolia has achieved tangible results in trade liberalization. Its joining of the WTO in January 1997 highlighted its success in economic reform and development of a new trade regime under internationally-accepted principles. WTO membership has allowed Mongolia to trade globally, with access to all member countries. Mongolian foreign trade was until 1990 totally dependent on socialist countries, especially the Soviet Union. Today, Mongolia has trade relationships with over 80 countries; over 80 percent of foreign trade is with Russia, China, the US, Japan and South Korea.

Between 1990 and 2004, the US granted Most-Favored- Nation status to Mongolia, removing quantity and quality restrictions on textiles, which was very significant for Mongolian exports. Currently, the European Union (EU) has approved Mongolian duty-free access from July 1, 2005, under a new trade preference scheme. This will allow Mongolia to export over 7,200 types of product to the EU in 2005-2015, duty-free. Mongolia’s main exports are minerals like copper, molybdenum, coal and fluorspar concentrate, and raw animal origin products like meat, cashmere, wool, casings, hides, skins, garments, carpets and blankets. Imports are mainly oil products, equipment and spares, vehicles, chemicals, food and consumer goods.

Laws have been passed for the establishment of free trade and economic zones, including the Free Economic Zones Concept, the Basic Free Trade Zone (FTZ) Law, the Altanbulag FTZ Status Law and the Zamy-Uud Free Economic Zone (FEZ) Status Law. The master plan for the Altanbulag FTZ has been drawn up and implementation begun. The Zamyn-Uud FEZ will have three orientations: tourism and service (including a casino); trade; and production.

In 2016, Mongolia traded with 157 countries and total external trade turnover has reached USD 8275.3 million, of which USD 4917.3 million were made up by exports and USD 3357.9 by imports.

Total external trade turnover decreased by USD 191.5 million (2.3 percent), of which imports were decreased by USD 439.6 million (11.6 percent) and exports were increased by USD 248.1 million (5.3 percent) compared with the previous year.

In 2016, surplus of external trade balance reached USD 1559.4 million, showing a growth by USD 687.6 million from an amount of USD 871.8 million recorded in 2015.

In December 2016, surplus of external trade balance reached USD 362.3 million, showing an increase of USD 123.0 million (1.5 times) from the previous month.

In the first 2 months of 2017, Mongolia traded with 111 countries from allover the world and total trade turnover reached 1316.3 mln.US dollars,of which 825.3 mln.US dollars were made up by exports and 491.0 mln.US dollars by imports.

Total foreign trade turnover increased by 350.9 mln.US dollars (36.3%), of which, exportsincreased by 212.0 mln.US dollars (34.6%) and imports increased by 138.9 mln.US dollars(39.5%) compared to the same period of the previous year.In the first 2 month of 2017, foreign trade surplus reached 334.2 mln.US dollars whichincreased by 73.1 mln.US dollars from 261.2 mln.US dollars in the same period of 2016.

The export rise of 212.0(34.6%) mln.US dollars was due to increase by 265.1 mln.USdollars in mineral products export, particularly increase by 283.4 mln.US dollars in coalexport, however export of precious stones, metal and jewellery decreased by 33.0 mln.USdollars, export of auto, air transport vehicles decreased by 31.7 mln.US dollars.

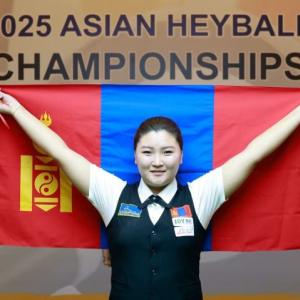

The import increase of 138.9(39.5%) mln.US dollars was mainly due to 56.0 mln.US dollarsincrease in mineral products import, specially 29.9 mln.US dollars increase in diesel importand 12.7 mln.US dollars increase in petrol importTo increase foreign trade, Mongolia has joined the World Trade Organization's Trade Facilitation Agreement and signed an agreement with Canada on stimulation and mutual protection of investment. The Economic Partnership Agreement between Mongolia and Japan has entered into force and as a first result of it, trade turnover of the two countries increased by 17 per cent, reaching USD344 million.

Foreign investment

The Government and State of Mongolia see foreign investment as a key factor in the country’s sustainable development. A Foreign Investment Law was adopted in 1991 and amended in 1993, 2001 and 2002 with basic objectives to encourage foreign investment, protect investors’ property and rights, regulate relations relevant to foreign-invested companies’ activities and has firmly followed this law since its inception. Moreover, it had set up a Government organization in charge of foreign investment matters, or the Foreign Investment and Foreign Trade Agency (FIFTA) in 1996. Within FIFTA’s 15 years of operation, foreign investment volumes registered in Mongolia has increased by 43 times. As mentioned above, Mongolia has a safe and sound legal environment for foreign investment. One of the three objectives in Mongolia’s foreign investment law is to protect investors’ properties and rights.

According to this law, there are free principles for investment, such as: enabling foreign investors to operate any types of business in all areas of production and all services, other than those prohibited by Mongolian laws; to establish wholly foreign-owned business entities or joint business entities with Mongolian investors, etc. The law also prohibits nationalizing or illegally confiscating foreign investors’ assets and/or capital. Foreign investors are to receive equal treatment to that enjoyed by domestic investors in regard to rights to own, utilize and exploit assets and capital.The country, while joining WTO pledged itself to grant the same privileges to foreign as to domestic investors.

Due to this pledge, since 2007 foreign investors have received treatment equal to that enjoyed by domestic investors. For instance, according to the corporate income tax law, investors are granted the under-mentioned tax exemptions:

1. Companies planting and/or producing grain, vegetables, milk, and all types of berries, enjoy a 50 percent tax exemption on revenue earned.

2. Tax credits equal to 10 percent of the invested amount are granted on investments in Mongolia’s priority sectors. In addition, where foreign entities invest not less than USD 20 million in Mongolia, the Mongolian Government is able to conclude stability agreements with these foreign investors, as legal guarantees for their operations to be carried on in a stable environment.

Mongolia has following competitive advantages for foreign investors:

- A stable political environment and an open economy.

- Strategic and easy access to the giant markets of Russia and China.

- Extensive natural resources.

- Favorable legal environment

- Relatively young and well-educated population.

- Vast territory, clean and undisturbed environment

Mongolia has agreements on avoidance of double taxation with 27 Asian and European countries, and has agreements on mutual protection and encouragement of investment with 34 countries. Mongolia joined the 1965 Washington Convention on Settlement of International Investment Disputes in 1996, and the 1985 Seoul Convention on investment insurance in 1999. The country is also a member of the World Bank Multilateral Investment Insurance Agency (MIIA ). Foreign companies created around 67,000 new jobs for Mongolians. Over 3000 foreigners working in Mongolia are introducing new management methods. Many well-known companies like Caterpillar, Samsung, Sumitomo, Coca-Cola, Itochu, Komatsu, Hyundai, Procter & Gamble, Ford and Mercedes-Benz are doing business here. Mining, tourism, infrastructure and agricultural processing are now major areas of foreign investment. With the Mongolian Citizen’s Land Ownership Law, the amount of direct foreign investment in construction and finance has risen.

Of foreign investment, 56 per cent comes from NEA countries, 24 per cent from North America, nine per cent from the EU and 11 percent the other regions. China accounts for 40 per cent, Canada 14 per cent, the US ten per cent, Korea seven per cent, Japan five per cent, Russia three per cent, and other countries 20 per cent. China, Korea, the Russian Federation, Japan, Germany and the US have the most economic entities registered for investment. In recent years there has appeared a growing trend for foreign investment in mining.

However, since 2014, the amount of Foreign Direct Investment (FDI) in Mongolia declined sharply and it currently is at 5 percent. The net sum of FDI decreased abruptly up to US $2098 million or by 52.4 percent in 2013 and US $542 or 74.2 percent in 2014; whereas, it was US $4620 million in 2011 and US $4408 in 2012. It means that the amount of FDI declined 8.5 times compared to 2011.

Mining

This is a major pillar of the economy, producing 30 per cent of all industrial output and accounting for 65.5 per cent of export revenue. There are around 350 mines and concentrators operating nationwide, employing more than 50 thousand workers.

Mongolia has rich mineral resources and mining of these has increased as the transition to a market economy proceeds. Mongolia has over 8,000 deposits of 440 different minerals, of which about 600 deposits and outcrops have been determined. There are 181 gold deposits, five copper-molybdenum, one lead, five tin, ten iron, four silver, magnesium and mica, three gypsum, three asbestos, three graphite, two bitumen, 42 black or brown coal, one of phosphorus, 42 of fluorspar, 12 salt, 10 sodium sulphate, 6 of semi-precious stone, nine crystal, 30 underground water deposits and 205 of construction materials like sand, gravel, limestone, marble, plaster, cement and mineral pigment. Exploration has been carried out of about 70 per cent of these, and the resources evaluated for industrial mining. Over 200 of these deposits are already being mined, of which 24 are non-ferrous metal deposits, 111 are gold, 34 coal, 15 salt and about 50 mineral deposits. In recent years, platinum has been found in Umnugobi, Bayankhongor, Uvs and Gobi-Altai aimags, making Mongolia even more interesting for mineral exploration and foreign investment

Most of Mongolia’s exploited copper is in the Erdenet mining and the TsagaanSuvarga copper-porphyry deposits. The country has considerably high-content copper-nickel and sandstone deposits, but no detailed survey has been made. Ivanhoe Mines Mongolia Inc has explored the OyuTolgoi deposit, identifying over 10 million tons of copper and 500 tons of gold. They say that with more detailed study, the resource may be even more.

The joint Mongolian Russian venture Erdenet is considered one of the biggest Ore mining and Ore processing factory in Asia and it accounts now for 13.5 percent of Mongolia’s GDP and 7 percent of tax revenues. Some 8,000 people are employed at the mine. Erdenet city, one of the youngest settlements in Mongolia, was founded in 1974 and it has today a population of over 100 thousand. For the last 36 years, Erdenet produced 14.9 million tons of copper, 115.6 thousand tones of molybdenum, and contributed Tgs5.1 trillion to state and local budgets, selling products worth USD10.4 billion

On June 20, 2015, the extension of the self-grinding section of the concentration factory was opened at Erdenet Mining Corporation. This is the largest extension work in the 37-year history of Erdenet. Presently, Erdenet has a capacity of processing 26 million tons of ore and producing over 500 thousand tons of copper concentrate per year. The deeper the ore mine goes, the more difficult the mining conditions get and the content of copper in ore is lower. A high content of pure copper in cooper concentrate is required on the market. Considering all these circumstances, the extension is constructed in order to avoid decreasing production size and income. Subsequently, the extension enables an increase in ore processing volume by 6 million tons to reach 32 million tons and the production of 580 thousand tons of copper concentrate with 23 percent copper content.

Apart from the Erdmin factory, that produces 3,600 tons of pure cathode copper a year from Erdenet deposit heap ‘ZesErdeniinKhuvi’ company will establish a copper-producing factory based on the oxidized-ore of the ErdenetOvoo deposit. On March 2, 2016, The Company established an investment and cooperation agreement with Blue Mon Group. The project to construct the plant with the capacity to produce 5 thousand tons of copper cathodes a year will begin next May. Total investment for the project is USD 45 million. The Ferrostaal Company of Germany will work as general executor of the project and Finnish Outotec Company will supply the equipment. The factory will be commissioned in 18 months.

Coal deposits are quite evenly distributed in Mongolia. Over 200 deposits of black and brown coal, the basic sources of Mongolia’s fuel and energy, have been identified in 15 areas. Exploration has been undertaken in 76 of these, and 40 deposits, including Baganuur, SharinGol, ShiveeOvoo, Aduunchuluun and Talbulag are being mined. UmnugobiAimag holds 65 percent of the total resources. The rest are in Bayankhongor, Selenge, Khentii, Sukhbaatar and Uvsaimags. Mongolian coal industry is mostly opencast, which is very economical. However, there are adverse environmental effects from this mining method.

The Baganuur Mining Company, the main provider of domestic coal consumption has extracted the 100 millionth ton of coal on February 8. 2015. The Baganuur company has a proven resource of 584 million tons of coal. This amount might increase to 900 million tons. The present extraction capacity is 3.8 million tons of coal per year. From 2016 to 2020, it will reach 10 million tons.

Deposits of coking coal are located usually in Gobi regions and provide the basic resource of coal exports of tha country. It is reported that ‘ErdenesTavanTolgoi’ JSC company alone constituted 29 percent of total coal exports of Mongolia last year by exporting 4.2 million tons of coal to gain USD 114 million. Some 3.8 million tons of coal came from its West Tsankhi deposit and the remaining was from the East Tsankhi deposit. Currently, exploration works are temporarily suspended because the agreement established with the Mongolian Miners Partnership, an executor in the West Tsankhi deposit, has expired. The Partnership had been operating in East Tsankhi since 2011 and in the West Tsakhi since 2013. During that period, a total of 14.4 million tons of coal was extracted. ‘TT JV CO’ has been exploring the East Tsankhi since the end of last year and has discovered 300 thousand tons of coal as of now.

As for Mongolian oil sector development in recent years, an agreement on the Tamsag basin field was established in 1993 with ‘Soko International’ Company and they started to extract oil in small amounts experimentally. In 2005, the contract rights and duties were completely transferred to the Chinese ‘Petro China’ Company. In the 10 years since 2005, investment of USD 2.6 billion has been made. As a result, operations have reached the industrial extraction level and they plan to extract 1.7 million tons of oil by 2017. Our country did not have financial resources to build an oil refinery, but since December 2012, the country started to produce crude oil and the amount of production has increased by 20-30 percent a year.

On May 4,2015, a ceremony was held in Ulaanbaatar to establish a product sharing agreement on oil exploration field ‘Uvs-1’ between the Government implementing Agency Petroleum Authority and ‘Mongolia GladwillUvs Petroleum’ LLC. The oil exploration field ‘Uvs-1’ covers a total area of 19724 square km including territories of UvsAimag’sSagil, Turgen, Tarialan, Umnugobi, Ulgii, Naranbulag, Malchin, Khyargas, BaruunturuunansDavstsoums. ‘Mongolia GladwillUvs Petroleum’ LLC will conduct the oil exploration on ‘Uvs-1’ field for a period of 8 years. As planned, the company will make a large investment of which USD 827 million will be spent on oil exploration and USD 31 million for reclamation.

On February 1, 2016, the Government charged the Minister of Industry to undertake all measures needed for building an oil refinery and pipeline in Bor-OndorSoum of KhentiiAimag as well as organizing a bid for consortiums with participation of national companies and negotiating a concession contract. Bor-OndorSoum of KhentiiAimag was chosen between Choir and Sainshand (Dornogobi) and Choibalsansoums (Dornod) because of its location near an oil deposit, infrastructure, logistical feasibilities, and its geographical proximity to the market. Technical and economic feasibility studies show that the supposed refinery would contribute to industrial production growth. Construction is planned to take four years. By 2021, when the refinery is put into operation, the amount of oil products imported is envisioned to decline while contributing to achieving balance in foreign trade. At the same time, a large number of jobs are expected to emerge along with many other economic benefits

As a result of the geological and exploration works being done with investments of private companies, the reserve of gold increased by 11 tons, the reserve of mixed metals by 17 thousand tons, the reserve of copper by 260 thousand tons, the reserve of tungsten steel by 288 tons, the reserve of silver by 64 tons, the reserve of zinc-by 137 thousand tons, coal reserve-by 1.7 billion tons and the reserve of fluorspar by 1.1 million tons.

During past two years, the Mining Ministry did quite a lot of work to make geology and mining sustainable for the long term in order to satisfy economic growth and refine the legal environment. For instance, the State policy on minerals sector, the Law on common spread minerals, Revised Law on Oil, Amended Law on mineral resources, and Amended law on nuclear

In 2014, Mongolia joined the International Committee for Mineral Reserves International Reporting Standards (CRIRSCO) as its 8th member and the first country in Asia. By doing so, it brings opportunities to attract investment from the stock market, bring it into the geological and mining sector, and let national professionals work in the international arena.

In Mongolia, there are five universities that train geological specialists and graduate about 100 students a year. There are over 4000 geologists throughout the country of which 50 percent actively work and over 60 of them are consultant geologists.

The Minerals Law of Mongolia, amended in July 2006, defines the mineral deposits of strategic importance as “a deposit... that may have a potential impact on national security, economic and social development of the country at the national and regional levels or that is producing or has a potential of producing more than five (5) percent of the total Gross Domestic Product in a given year”. In February 2007 the Mongolian Parliament adopted a resolution by which a total of 15 deposits are defined as deposits of strategic importance.

On January 16, 2014, Parliament adopted a parliamentary resolution ‘State Policy on Mineral Resources’. The document is very significant because it has determined a State unified policy on the minerals sector for the first time and reflected principles to reduce state participation in the sector, follow a stable legal environment and make it transparent. The State Policy includes key principles, such as to be open and transparent, make legal environment stable as much as possible and not to classify investors and not to differentiate them by types of properties. A policy will be adhered to develop the sector based on Public and Private Partnership.

According to the Mineral Authority, mining investments of domestic firms consist of 74.1 percent of all investments. Foreign investment accounts for nearly 20 percent while joint companies invested the rest. A total of 1,763 mineral licenses have come into effect to give relevant rights of mining operations covering 15.1 million ha or 9.7 percent of all territory of the country. Most of the licenses were issued for gold (35.4 percent) and coal (17.3 percent) mining, while fewer permits have been allowed for mining operations of construction materials (20.7 percent), spar (12.1 percent), iron ore (4.2 percent) and wolfram (2.1 percent). Mongolia with its rapidly developing mining sector is now making significant efforts to bring its geological and exploration sector to international standards.

From January 26, 2015, the mineral resource authority of Mongolia has been started to receive and solve the requests for special permission for exploration. Some 19.9 percent of Mongolia’s territory or 31 million square ha will be covered by special permission. On 71.5 percent of country’s territory, it is prohibited or restricted for special permission accounts. Special permission will be granted by application for 13.4 percent of the total territory or 20.9 million square ha; whereas 6.5 percent or 10.1 million square ha by selection method. According to the law on mineral resource adopted by Parliament on July 1, 2014, the Government determined the amount of land to be covered with special permission by coordinates. Thus, the legal environment to attract investment into the mining sector, increase mineral resources, boost development of geological exploration sector was provided.

Since mining is the backbone of Mongolia’s economy and the SouthGobi region has experienced a major mining boom. Today, the biggest mining companies such as‘OyuTolgoi’, ‘Erdenes Mongol’, ‘ErdenesTavanTolgoi’, ‘South Gobi Sands’, ‘Terra Energy’ and ‘Gobi Coal and Energy’ are operating in the South Gobi region.

The OyuTolgoi is currently the biggest project in Mongolia. This is why it has becomes a hot issue – some support the project, others opposite it and are against investors. This project was positive from the point of view of introducing new technology, creating new jobs, improving wages and salaries, and accelerating national economic growth in general. But at the same time, there are many things that could be criticized. After 19 months of completing the OT open-mine and beginning to export the first part of concentration on February 18, 2015, the amount of copper concentrate exported to international markets reached one million tons. The mine produced a total of 148,400 tons of copper concentrate and 589,000 ounces of gold concentrate. Ore extracted from the open mine is being processed at its own crushing and concentration plant. The country is expecting for the positive impact from the successful resolution of financing for the OyuTolgoi underground mine.

In December 2014 the government awarded a deal to develop the massive TavanTolgoi (TT) coal field to a consortium comprising Energy Resources/MCS (Mongolia), Shenhua (China), and Sumitomo (Japan); talks continue to hammer out the financing and the operating details.

In spite of the price drop of mineral raw materials at the international market in 2015, more than 250 mines and mining plants operated actively to account for 67.2 percent of GDP and 78.8 percent of total exports. According to the Mining Ministry, the mining sector, held 19 percent of the state budget of Mongolia, extracted 24.1 million tons of coal, 14.6 million tons of gold, 1.2 million tons of oil, 1 million 477.8 thousand tons of copper concentrate and exported 5.1 million tons of iron ore, 11.3 million tons of gold, 14.5 million tons of coal and 1.1 million tons of oil last year.

In January 2016, Mongolia extracted 2 million tons coal, 569 kg of gold and 110.7 thousand tons of oil and produced 11.4 thousand tons of fluorspar concentrate, 23.2 thousand tons of ore concentrate and 6.2 thousand tons of zinc concentrate.

Energy

The energy sector’s development is a major factor of national security and a pillar of economic development. In recent years, Mongolia has experienced a high growth of energy demand with intensive development of the mining and construction sectors.

The energy sector’s development is a major factor of national security and a pillar of economic development. In recent years, Mongolia has experienced a high growth of energy demand with intensive development of the mining and construction sectors.

In coordination with rapid social and economic development of Mongolia, notwithstanding its stable and reliable supply of energy to meet the country’s demands, there are urgent issues in the energy industry to improve labor productivity, to reduce domestic consumption of thermal power plants by increasing efficiency, and to implement a savings policy at the consumer level.

Mongolia’s economic growth is driving its electrical energy consumption upward of 7-10 percent year by year. It is estimated that the energy use of Mongolia will grow 510 times by 2030. Most of the currently-in-use thermal power plants and distribution stations of Ulaanbaatar, Darkhan and Erdenet cities and DornodAimag were built from 1960 to the 1980s and the majority of their facilities and equipment is outdated.

In terms of natural resources, Mongolia has 173.3 billion tons of coal resource of which 23.5 billion tons are proved by comprehensive exploration as calculated last year. Therefore, the Government of Mongolia is making efforts to create new energy resources by building power stations and generators based on its rich mineral deposits and to renovate its existing power generators with a view to not only fully supply its domestic demand but also to export energy to Asian countries.

As of 2015, coal-fired thermal power stations make up 85 percent of total capacity of electrical generation nationwide and wind power comprises 5 percent, diesel generators compose 7 percent, hydro power 2 percent, and small sized renewable energy sources comprise 0.62 of the remaining total energy capacity. Also, some 80 percent of the electrical supply is produced domestically and 20 percent comes from abroad.

As of 2015, coal-fired thermal power stations make up 85 percent of total capacity of electrical generation nationwide and wind power comprises 5 percent, diesel generators compose 7 percent, hydro power 2 percent, and small sized renewable energy sources comprise 0.62 of the remaining total energy capacity. Also, some 80 percent of the electrical supply is produced domestically and 20 percent comes from abroad.

The Government launched an energy program for 30-40 years. In this light, several energy sources are planned. Mongolia implements major projects called megaprojects as pillars of development. Megaprojects-by definition must cost more than 1 billion US dollars, must take more than 5 years to move from design to operations, must affect more than a million people and must have a transformational impact. In the energy sector, these projects are EgiinGoliin Hydro Power Plant, Tavantolgoi power plant, Combined Heat and Power Plant #5 and CTL (Coal-to Liquid) Project at Baganuur. Construction of the Baganuur electric power plant will take three years. By 2019, it will supply electric power to the central and eastern regions. This is a large project carried out under a concession contract.

Combined Heat and Power Plant #5 is particular for being the largest in the history of the energy industry of Mongolia where the government participates along with the private sector. The construction work launched in the first quarter of 2016 and last four years. Moreover, it will be the largest thermo electric power plant in Mongolia. The project costs USD 1.5 billion. Raw materials for production will be supplied from the Shivee-Ovoo and Baganuur coal mines. TEPP-V will produce both electrical and thermo energy with the capacity of 3 million mW/h each. Albeit the power plant will consume coal in its production, it is able to keep the emission of greenhouse gases to a minimum level thanks to the new high technology. At the construction stage, up to 2700 jobs will be available and many subcontractors will be afforded a chance to make money. With accomplishment of the project, the growing demand for electrical energy and heat will also be covered in eastern districts of the city and aimags of the country.

Combined Heat and Power Plant #5 is particular for being the largest in the history of the energy industry of Mongolia where the government participates along with the private sector. The construction work launched in the first quarter of 2016 and last four years. Moreover, it will be the largest thermo electric power plant in Mongolia. The project costs USD 1.5 billion. Raw materials for production will be supplied from the Shivee-Ovoo and Baganuur coal mines. TEPP-V will produce both electrical and thermo energy with the capacity of 3 million mW/h each. Albeit the power plant will consume coal in its production, it is able to keep the emission of greenhouse gases to a minimum level thanks to the new high technology. At the construction stage, up to 2700 jobs will be available and many subcontractors will be afforded a chance to make money. With accomplishment of the project, the growing demand for electrical energy and heat will also be covered in eastern districts of the city and aimags of the country.

Construction of the Buuruljuut Thermal Power Plant in Tuv Aimag with the capacity of 600 MWt is currently underway. Its implementers Power Station Resources from China and MCS International are planning to finish the project which costs USD 1 billion in 2019. The Plant will begin operating based on the Buuruljuut coal deposit. Also, another major project waiting to begin this year is the 600 MW Tevshiin Gobi Power Plant in Dundgobi Aimag which will function based on the Tevshiin Gobi lignite deposit. The Plant will supply Ulaanbaatar, the Sainshand Industrial Complex, as well as some big deposits with energy and its total investment is USD 1 billion.

Construction of the Buuruljuut Thermal Power Plant in TuvAimag with the capacity of 600 MWt is currently underway. Its implementers Power Station Resources from China and MCS International are planning to finish the project which costs USD 1 billion in 2019. The Plant will begin operating based on the Buuruljuut coal deposit. Also, another major project waiting to begin this year is the 600 MW Tevshiin Gobi Power Plant in DundgobiAimag which will function based on the Tevshiin Gobi lignite deposit. The Plant will supply Ulaanbaatar, the Sainshand Industrial Complex, as well as some big deposits with energy and its total investment is USD 1 billion.

Mongolia is one of countries that has huge resources of renewable energy and has full potential to exploit renewable energy. It is said that Mongolia’s potential to produce enough electricity from its wind resources to equal the volume of energy produced by seven nuclear power plants

Mongolia set a goal to supply some 20 percent of its energy consumption with renewable energy sources by 2020 and 30 percent by 2030. This is a big step Mongolia is taking against global warming. The government is concentrating on rural electrification in its three-stage 100,000 Solar Energy Gers program, 2000-2020. In this, Tg250 million will be spent from the central budget on solar energy panels for herder households. The Government has pledged also to supply more than 100 Soumcentres with renewable energy and supply every rural family with solar power. Mongolia ranks second in the world in solar energy resources. The generation of solar energy in Mongolia accounts for 900 megawatts. The potential of solar energy is so huge that according to present calculations, solar energy that comes to Earth every minute is enough to satisfy the current global demands in energy all year around. The potential of solar energy is huge in Mongolia as there are 250 sunny days a year. The country doesn’t use this enough, but the situation is now changing.

Today, about 70 percent of the herder households benefit from solar energy thanks to solar panels. Mongolia is unique country for hosting both settlement and nomadic civilizations. Out of its three million population, nearly 800 000 are herder people. The majority of them are now active users of cell phones, refrigerators and TV sets through which they are kept informed of essential weather forecasts. Cell phones charged with help from solar panels keep herders in touch with their children studying far from their home and make calls wherever they need such as medical centers in case of emergency without going far which was previously impossible. Sunkou Solar Mongolia Company has greatly contributed to making all this happen. Sunkou Solar Mongolia Company is the first in Mongolia to produce high quality solar panels. The company started conducting activity to produce and trade solar panels beginning January, 2011.

Since 2000, the energy sector and the US National Laboratory of Renewable Energy have drawn up a map for Mongolia’s wind energy. It shows that a wind park able to generate 2.55 million GW of electricity a year is possible. Plans are in place for wind generators across 10 per cent of the country. It is said that Mongolia’s potential to produce enough electricity from its wind resources to equal the volume of energy produced by seven nuclear power plants. It means having the sufficiency to supply a 220 thousand ha area with energy, emphasized the sector specialists.

On June 20, 2013, Mongolia’s first ever wind farm near the capital of Ulaanbaatar put into operation and started to supply its electricity to the central energy system. The power station was built at the Shalkhitmountain in Sergelensoum of Tuv province which is the central part of Mongolia. The Salkhit wind farm’s construction work and studies of wind energy resources were implemented by the National Newcom Group with its partners such as General Electric Pacific Company, European Bank For Reconstruction and Development, and the Clean Energy company with investment of the Netherlands Development Finance Company. The Wind farm has an initial installed capacity of 68,5 million kilowatt/hours electricity which is adequate for the yearly energy needs of 100.000 households. Each of 15 giant wind turbines is 80 meters tall with 3 sections and weight 125 tons. The wind farm save 122.000 tons of coal and 1,6 million tons of water each year. It also decreases greenhouse gas emissions by 200 thousand tons.

The Energy Regulatory Authority has granted also special permission to Sainshand Wind Farm LLC to set up a wind farm at a place 15 km away from Sainshand, the center of Dorngobiaimag. The wind farm project is being implemented. The main shareholder and project developer is Ferrostaal Industrial Projects Company from the city of Essen in the Federal Republic of Germany. An annual production of the farm will be about 190 million kw to the national network. The project investment is approximately 110 million dollars and investment is being made by leading global banks and financial organizations. The government has made significant investment for technical and technological innovation in the sector. Foreign investment is being called for to ensure reliable power and a united network to provide rural areas with electricity. Hydro power plants were built in Gobi-Altai, Zavkhan, Khovdaimags with power for the centres of Khovd, Bayan-Olgii and Uvsaimags and neighbouringsoums.

The construction work of the Eg River Hydro Power Plant (ERHPP) will be started in late March 2016. The dam construction is planned to start at the beginning of 2017. All the other construction and infrastructure works are being executed according to plans, and it is stated that they will be completed at the end of 2016. According to the FS, a total of USD 827.6 million is required to build the plant which will produce energy worth 1.4 cents, which is 5 times cheaper than energy generated from thermal power plants. The Government of Mongolia resolved to finance the ERHPP on March 9, 2015 and commenced talks for a soft loan from the People’s Republic of China.

Structural reform and preparations to privatize state properties are also being carried out in the energy sector. Mongolia plans to have its first nuclear power plant by 2020 and build nuclear fuel production capacity by tapping the country’s rich uranium resource. Mongolia has proven uranium reserves of about 80,000 tons, ranking it among the top ten in the world.

Construction

In 1921-1990, Mongolia provided 100 thousand household with comfortable apartments. In 2008, the construction sector employed 50 thousand people. In 2000-2012, 5 thousand families were paying mortgage loans with an annual interest rate of 20 percent. Then, in the last three years only 25 thousand apartments were commissioned and 96 thousand individuals were employed in this field. Between 2013 and 2015, Mongolia commissioned an average 1322 sq. meters of living space a year and granted mortgage loans to 76 thousand households.

In 1921-1990, Mongolia provided 100 thousand household with comfortable apartments. In 2008, the construction sector employed 50 thousand people. In 2000-2012, 5 thousand families were paying mortgage loans with an annual interest rate of 20 percent. Then, in the last three years only 25 thousand apartments were commissioned and 96 thousand individuals were employed in this field. Between 2013 and 2015, Mongolia commissioned an average 1322 sq. meters of living space a year and granted mortgage loans to 76 thousand households.

All these indicate that the construction sector has reached economic effectiveness which can replace the mining industry. Moreover, the construction development raised a demand for builders in the labor market. From an economic point of view, production costs in the construction industry are decreasing. Meanwhile, it has a positive impact on other production sectors. Namely, 945 manufactures produces 79 kinds of construction materials and other products for construction industry growth and effectiveness which demonstrates the outcome of the Chinggis bonds. Presently, 95,695 jobs are available in this area and 12,108 students have been trained. Last year, 68 percent of 4,777 graduates got jobs. This is a tangible outcome of the 8 percent mortgage loan policy. The second stage of the mortgage program started and the interest rate of housing mortgages issued to 18,450 households living in some districts of Ulaanbaatar and rural areas in 21 aimags will be lowered to 5 percent in the near future.

The construction sector and manufacturing of construction and building materials intensified and thousands of jobs were created thanks to a low-interest housing mortgage program that has been implemented since 2012.

The Government ‘Housing program’ aims to provide citizens with cheaper and good quality apartments, support a national construction and for professional workers to be employed in the construction industry. Some 200 companies including suppliers and executors participated in the construction of the town and a total of 3200 professional workers worked in the construction process.

Mongolia is a country with harsh and extreme winter conditions, so construction work intensifies in the warm seasons. Currently, over 4000 economic entities are running construction activities with special permission; thus, the number of workers in this sector also increased. According to a survey, currently, about 70 percent of the capital’s residents live in ger districts. These citizens dream of living in apartments. A recent study conducted by the Mongolian National Construction Association shows that over 70 percent of citizens want to live in two-room apartments.

Mongolia is a country with harsh and extreme winter conditions, so construction work intensifies in the warm seasons. Currently, over 4000 economic entities are running construction activities with special permission; thus, the number of workers in this sector also increased. According to a survey, currently, about 70 percent of the capital’s residents live in ger districts. These citizens dream of living in apartments. A recent study conducted by the Mongolian National Construction Association shows that over 70 percent of citizens want to live in two-room apartments.

A program ‘Rental apartment’ is planned to be implemented in 2015- 2016. Within the frameworks of program, rental apartments for 800 families will be built in Ulaanbaatar and aimag centers respectively under the public and private partnership.

In the first stage of constructing the “Buyant-Ukhaa-2” apartment town, 20 apartments with 9 floors for 1620 families, a kindergarten for 240 children and 6 shopping and service centers with 5 floors were built since June, 2014. Planned construction for the second stage include 60 apartments with 12 floors, 3 kindergartens for 240 children each, 2 complete schools, a united parking garage with 7 floors, gardens, a sport complex and shopping centers. The ‘State Housing Corporation’ state owned entity was established in 2013 and an apartment complex started to be constructed under its order.

By now, 18,882 newly commissioned apartments are waiting for their owners whereas some 50 thousand apartments are under construction. There are 189 thousand persons living in ger districts who want to move to apartments where there are 169 thousand households who wish to benefit from the mortgage program.

Processing

Mongolians are nomads who conduct animal husbandry and live on its yield rather than using natural resources. Thus, Mongolia has every opportunity to produce final products of animal origin. Since ancient times, Mongolians have developed a tradition of consuming products of animal origin, drying meat, twinning wool and hair, house wares, and making clothing from animal skins.

The country processes wool, cashmere, leather, wood, metal, textile, and food, and the recession in the processing industry is over. The main cause of decline over the past decade, especially in raw agricultural processing, was a shortage of finance, leading to an inability to buy raw materials and an under-utilization of capacity. The government took a number of measures. Processing of raw animal-origin materials such as leather, cashmere and wool now plays a dominant role in the processing industry.

Mongolia is the world’s second largest producer of cashmere. One of the biggest wool and cashmere processors is the Gobi (shareholding) company, which makes and exports over 60 per cent of the nation’s wool and cashmere items. The ‘Gobi’ company was founded in 1981 by the joint effort of Mongolian and Japanese governments with an aim to produce 100 percent natural cashmere and camel wool. The company is ranked among the first five in the World with its collections for four seasons. The ‘Gobi’ has the staff of about 1200. Textile production and exports have increased in the last few years, to over ten per cent of all exports. Favorable international trade conditions have encouraged textile exports, and knitted products exports have increasing steadily. In recent years, Evseg cashmere, Khatansuljee LLC, Snow Fields LLC and Cashmere Holding LLC etc., appeared at the cashmere producers’ market of the country.

According to the Mongolian Cashmere& Wool Association, cashmere exports bring in an average of around $250m annually and provide employment for some 7000 people.While Mongolia has a long history of exporting raw cashmere, the country is working to develop greater valueadded processing capacity to maximize sector returns. Ultimately, the industry is looking to progressively scale back shipments of raw cashmere, with a view to essentially end unprocessed exports by 2020. Manufacturers have been importing new technology in recent years – primarily from Italy, a leader in the international textiles market.

Until 1990, Mongolia produced 4 million pair of shoes, 280 thousand sheepskin coats and a hundred thousand leather coats a year to become one of the countries with a well-developed tanning industry. Mongolia prepares 8-10 million pieces of animal skins a year, 100 percent of which are semi processed. Italy, Turkey, Vietnam, France, the Republic of Korea, China and other countries buy semi processed leather from Mongolia. Previously, China imported 100 percent raw hide and since 2009, national tanneries have been buying raw hide. For instance, in 2013 the national tanneries bought 10 percent of the raw hide whereas last year, this figure reached 37 percent. The goal is to purchase 100 percent of raw hides within the country in the coming 5 years.

Presently, only ten percent of raw hides are fully tanned. In the future this will be reached 80 percent in 5 years. Thereby, the necessity emerges to modernize technology and equipment, train human recourses, and use high quality suing chemicals. There are about 30 tanneries now operating in Mongolia and over 90 entities produce final products.

Government bonds help national light industry to grow. The DarkhanNekhii Company manufactures 500 thousand pieces of sheepskin and leather garments each year and its shoe factory has provided the domestic market with 500 thousand pairs of shoes. Also, the company created their own ‘Horse’ brand. The DarkhanNekhii Company was issued a Tgs 14 billion loan at 4 percent annual interest and a 5-year term. Recently, they started selling their products on www.alibaba.com, an online trading website.

DarkhanMinj LLC supplies domestic and foreign markets with sheepskin coats and leather items of good quality and international standards thanks to its new technologies and equipment installed using financing from the bond issued by DBM. The company also provides winter clothing for military personnel. By virtue of learning experiences from Turkish and Spanish specialists, DarkhanMinj now tans 250 thousand pieces of sheepskin and manufactures 20-35 thousand coats, hats and gloves annually

In the first month of 2016, leather producing factories made products totaling Tgs 1.9 billion and sold leather and hides amounting Tgs 500 million on the domestic market and Tgs 1.5 billion to foreign markets. The Government allowed exporting leather products for one month starting January 5, 2016. In connection with this decision, the export of processed leather products increased by 60 percent to reach USD 1.2 million. The export of processed leather products to China increased five times.

Agriculture

Mongolia is remote, with limited infrastructure, a small market, harsh climate, landlocked geography, nomadic livestock and low population density. The high dependency on livestock highlights the volatility and risks from weather influencing the Mongolian economy. Livestock output is almost 80 per cent of the total agricultural output. The food and agricultural sector comprises processing, food, livestock and crops.

Livestock

Livestock is the main livelihood and source of wealth and the economy depends substantially on the sector, employing about 49 per cent of the labor force. Over 97 per cent of livestock is now privately owned by 256,600 families, 72.3 per cent of whom (185,500 households) are solely dependent livestock-generated income. According to the 2015 livestock census, the number of livestock reached 51.9 million head, showing an increase of 6.8 million head or 15.1 percent against the previous year.

Almost half of all Mongolians run extensive livestock and non-intensive crop production activities, highly dependent on weather. Recent weather patterns have been very negative for agricultural production. Mongolia has recently been drier and more prone to drought and dzud. Over 41 per cent of Mongolia is semi-desert (gobi), frequently affected by dzud and drought. Dzud happens frequently in Mongolia. Based on livestock mortality data provided by the National Statistics Office, serious livestock losses occur once in every five years. Historical records suggest that Mongolia lost 30% of livestock in 1944 due to dzud. More than 10,000 herder families lost all of their animals due to harsh winter disasters from 2000 to 2002. Index-based insurance is a novel scheme used widely in agriculture, particularly crop growing in developing countries. This concept was introduced in animal husbandry in 2005 and Mongolia became the first IBLI pilot country. All the IBLI insured herders are subject to risks affected by Dzud and if Dzud occurs, IBLI covers losses from pooled funds. Thus, IBLI has a collective fund from four local insurers, namely Mongol Daatgal, Prime Daatgal, TushigDaatgal, and BodiDaatgal and herders contribute to the fund even if their soum is not affected by disaster, and this Livestock Insurance Indemnity Pool (LII P) account is utilized to cover losses of those insured herders affected.

Almost half of all Mongolians run extensive livestock and non-intensive crop production activities, highly dependent on weather. Recent weather patterns have been very negative for agricultural production. Mongolia has recently been drier and more prone to drought and dzud. Over 41 per cent of Mongolia is semi-desert (gobi), frequently affected by dzud and drought. Dzud happens frequently in Mongolia. Based on livestock mortality data provided by the National Statistics Office, serious livestock losses occur once in every five years. Historical records suggest that Mongolia lost 30% of livestock in 1944 due to dzud. More than 10,000 herder families lost all of their animals due to harsh winter disasters from 2000 to 2002. Index-based insurance is a novel scheme used widely in agriculture, particularly crop growing in developing countries. This concept was introduced in animal husbandry in 2005 and Mongolia became the first IBLI pilot country. All the IBLI insured herders are subject to risks affected by Dzud and if Dzud occurs, IBLI covers losses from pooled funds. Thus, IBLI has a collective fund from four local insurers, namely Mongol Daatgal, Prime Daatgal, TushigDaatgal, and BodiDaatgal and herders contribute to the fund even if their soum is not affected by disaster, and this Livestock Insurance Indemnity Pool (LII P) account is utilized to cover losses of those insured herders affected.

Furthermore, certain share of annual premiums saved in the reserve accounts, so a herder who has got insurance in a given year would be paid an indemnity payment in case of disasters. Parliament has, for the first time, approved a State policy to support herders. This policy, approved on June 5, 2009, includes creating conditions to enable herders to live decently, improve labor, social welfare and health systems, upgrade and coordinate animal husbandry and associated production, develop ways to sell products, establish a voluntary based civic society structure and improve herders’ livelihoods.

The State’s Policy on Herders is to be implemented in two phases, 2009-2015 and 2015-2020. In the first phase it is planned to increase herders’ income by not less than 50 percent and involve not less than 70 percent of herders in health insurance and not less than 50 percent in social insurance. In the second phase, it is planned to increase herders’ income by not less than 80 percent and involve 100 percent of herders in both health and social insurance.

Parliament also approved a Resolution on June 11 to exempt herders and people managing animal husbandry from paying tax on income earned from their animals, as well as exempting unprocessed cashmere from export tax. The tax on animals is collected twice a year and, as some herders have already paid this, the law came into effect on July 16, 2009.

On February 22, 2016, the Government approved the Good Herdsman program to raise productivity and efficiency of animal husbandry and encourage herdsmen and farmers. The program is charted to promote enduring application of progressive technologies in animal husbandry production and widen access to financial services, and provide for improving productivity and product competitiveness through increasing animal output, fostering exports and raising the income and livelihood of herders and farmers. The program is designed to be implemented in two stages until 2020 with a key objective to provide better living conditions in rural communities. Following approval of the Good Herdsman program, a subprogram was passed by the Cabinet to support animal husbandry production and make sure implementation of the Good Herdsman program’s goal of encouraging enduring introduction and application of the latest technology for improving the quality and efficiency of animal husbandry. It is indispensable to boost animal husbandry production and introduce technology which is conducive to developing VAT-added production. The financial sources required for this were settled by the Cabinet by providing soft loans with a 10 percent interest rate via commercial banks. According to criteria set-out in the subprogram, the soft loans are available for acquiring various vet preparations needed for keeping the livestock healthy, buying small-sized tractors and equipment as well as technology for improving livestock breeds.

Food sector

Meat and meat products have an important place in the food sector and are considered to have the most potential for development. There are 22 medium and large slaughterhouses, able to process a total of about 62,000 tons of carcasses a year, although they are only using 29 per cent of that capacity. There are many smaller slaughtering facilities in aimag and soumcentres. There are over 60 small and medium enterprises that produce meat products. Local meat production is sufficient for domestic demand, and some meat products are exported. Per person meat consumption has risen to 120kg a year.

Makh Market’ LLC, the largest meat processing company of Mongolia. ‘Makh Market’ LLC started its activity in 2004 producing meat and meat products and has grown into an internationally accepted entity. Their facility has storage capacity of 7500 tons and is equipped with the latest technology in deep freezing. The company also has workshops for conducting the slaughter of 1000 head of small livestock a day, deboning 4-5 tons of small and large livestock meat, as well as semi-processed products with the capacity to produce 5 tons of buuz, dumplings and meatballs per shift and producing 5 tons of ham and sausage per shift. As of today, ‘Makh Market’ LLC supplies the domestic market with 35 processed meat products of 14 different varieties, 14 semi-processed products of 7 different types and graded meat. All the production lines and processes are carried out according to international standards to guarantee product quality. The Internal inspection laboratory of ‘Makh Market’ LLC was accredited by the MNS ISO/IEC17025:2007 standard in 2011 and the laboratory performs over 40 types of chemical, physical, microbiological and serological tests and analyses on meat and meat products, and ensures safe food for human consumption. The company also implemented the HACCP system which stands for Hazard Analysis and Critical Control Point, which is an internationally accepted system for food safety assurance into their meat processing plant in 2011, which was certified by an SGS Internationa Auditing Firm. They also applied the ISO 22000 Food Safety Management System into their operations that is a valuable contribution to the development of the food industry of Mongolia. ISO22000 standards provide identification, prevention and elimination of any food safety hazard at each and every level of food processing and ensures for a clean and sanitary environment.

Mongolia plans to export a total of 51 thousand 400 tons of meat and meat products in the first half of 2016. Some 66 percent of the meat is to be made up by mutton and goat meat and 22 percent by horse meat. In January, only horse meat was exported totaling USD 539.7 thousand.

Crops and vegetables

Mongolia has over 130 million hectares of agricultural land, of which 217,600 ha are arable. The main crops are cereals, potatoes, other vegetables and fodder. Only 497,000ha are being cropped at present, but intensive farming methods are developing. In 2008-2009 the Government of Mongolia successfully carried out its nationwide III Campaign for Reclaiming Virgin Lands. The campaign produced: 205.8 thousand tons of wheat harvested nationwide, or more by 91.2 thousand tons than the previous year’s harvest.

This year’s autumn harvest has enabled Mongolia to be 50 percent self-sufficient in meeting crop consumption needs, as well as supplying 49.6 percent of required potatoes and vegetables - proving that the country can fully provide its domestic needs for crops, potatoes and vegetables

Many small and medium factories and entities are producing milk products in towns and soums. The dairy industry suffered during the early years of transition to a market economy, with a sharp fall in dairy production. There is a network of flour mills able to produce over 300,000 tonnes a year. There are eight large grain storage facilities, total capacity of 250,000 tons.

Mongolia produces a third of its total domestic flour needs. The ten big flour factories have a total production capacity of 163,000 tons.

Transport

Mongolia is historically associated with the Silk Road, a golden link in the history of roads. The old means of transport were camels, horses and oxen. Modern transport was seen in Mongolia only at the beginning of the 20th century. Transport is very important for the development of Mongolia, with its vast territory and sparsely settled population. The transport sector has four sub-sectors: roads, rail, air and water.

Mongolia is historically associated with the Silk Road, a golden link in the history of roads. The old means of transport were camels, horses and oxen. Modern transport was seen in Mongolia only at the beginning of the 20th century. Transport is very important for the development of Mongolia, with its vast territory and sparsely settled population. The transport sector has four sub-sectors: roads, rail, air and water.

Civil aviation

With a sparse population and severe winter weather, roads and rail are not well developed in Mongolia. Air transport is important, especially for tourism, because of the importance of this industry to the general economy. Without proper air transport infrastructure connecting Ulaanbaatar and the regional centers, tourism would be disadvantaged. Airports, airline services and tourism are linked; none can be considered in isolation.

May 25, 1925 was the first time ever for a Russian four-seat Y-13 airplane to land on the present American Embankment in the territory of the Bayanzurkh district, in Ulaanbaatar, which demonstrated aviation to locals. This was the starting point of Mongolian civil aviation.

Today, the civil aviation of Mongolia employs over 2000 people and operates airports in 15 aimags of the country. Mongolia numbers 8 airlines and a total of 250-300 flights pass over the territory of Mongolia each day.

Mongolia joined the UN International Civil Aviation Organization 1989. By aviation safety assessment, Mongolia ranks 15th in the world and is among the top 5 in Asia and the Pacific region. Mongolia has an aviation agreement with 35 countries. Air passenger transport is the most important aviation activity. By 2014, 38 aircraft were registered in Mongolia, of which 21 have a certificate to qualify for flight. In 2014, 4 foreign airlines and 3 Mongolian airlines ran air transportation activities and conducted scheduled flights in 17 international and 12 local directions.

Mongolia unquestionably is a country with the “most favorable” location for aerial transportation between Asia and Europe, Europe and the Pacific. In this sense, the importance of Mongolia’s “eternal blue sky” is becoming much more important and increasingly significant.

Starting March 16, 2015, Mongolia has launched transfer a new system that reduces the safe distance between aircrafts to 30 km. Before, the safe distance between aircraft was not guided by a real observation system and the safe distance between two aircraft was 150 km. By installing a real observation system or radio-locator, the safe distance was reduced to 90 km. Now, a reduction to 30 km will be implemented. By reducing the safe distance between aircraft, the ability to cross Mongolian airspace will be improved, the number of flights will increase, and it will be an important contribution to the development of the air transport industry. Experts concluded that without a dispatcher queue at the border and by providing more opportunities for aircraft to reach their efficient height, there will be great progress towards economic profitability by reducing flight time, fuel consumption and air pollution.

Reducing aircraft separation requirements in a safe manner will allow the Mongolian Civil Aviation Authority (MCAA) to more rapidly increase air traffic flow with economic benefits across the country and the region. In other words, new standards will result in more flights over Mongolian airspace. Furthermore the move is also expected to ease air traffic congestion between Europe and East Asia, including China, Southeast Asia, Japan and the Republic of Korea. To reduce aircraft separation distances, MCAA implemented many measures including installing required equipment, developing procedures and contingency planning, and organizing air traffic control training. As a result, the total number of international flights passing through Mongolian airspace will increase. Some 90 per cent of MCAA’s income comes from payment for navigation services given by foreign airlines passing through Mongolian airspace. Some 45 to 54 percent of the payment goes to State Budget according to relevant laws and the amount has increased in the past few years.

To adhere to its mission statement and provide customers with a safe and efficient air transport infrastructure, MCAA has upgraded Ulaanbaatar’s ChinggisKhaan international airport, is re-equipping the MIAT domestic fleet with newer aircraft and is upgrading seven regional airports.

They are also upgrading the aviation security system to world standards. ChinggisKhaan is the gateway to Mongolia, 18km southwest of Ulaanbaatar city, with both international and domestic services. The upgrading project began in 1993, funded by an ADB Loan. Like many airports around the world, it operates 24 hours a day, and in accordance with ICAO standards, has a 4D-category field able to handle any aircraft, with all necessary ground handling equipment and facilities.

MCAA annually registers 30,000 transit flights. With the opening of transpolar air routes between North America and south-east Asia, flights over Mongolia will increase, because this gives great saving of flying time. This also means that airlines will be looking for suitable alternative airports for an emergency situation or for technical or refuelling stops because of adverse weather conditions affecting their flight times and fuel burn. Ulaanbaatar’s central location means Mongolia could play an important role as a new cargo hub and distribution point for cargo and passengers to Siberia and northern China. The site is about 7km southwest of the town of Zuun Mod, 36km from ChinggisKhaan airport, in an open, level valley area, about 1,380 metres above sea level.

Mongolian Airlines (MIAT) is an airline whose roots go back to the Mongolian Air Force of 1925.In 1946, a true civil air detachment for local services in Mongolia was set up, but it was not until 1987 that MIAT started international services with Tupolev 154 aircraft from the former Soviet Union. MIAT flies from Ulaanbaatar to Moscow, Irkutsk, Beijing, Hohhot, Berlin, Seoul, Tokyo and Osaka, using leased A-310-300 and B-737-800 aircraft, while Antonov AN -24s operate the domestic routes. Starting on June 16, 2009, MIAT, the Mongolian Aviation Company is to offer direct weekly Ulaanbaatar-Berlin-Ulaanbaatar flights on Tuesdays.Flights to Berlin had previously been via Moscow and these are to continue twice a week as in the past, and means the number of weekly MIAT flights to Europe has increased to three.

Aero Mongolia, a private company, has a contract with MIAT for domestic routes with Fokker planes. Some 99 per cent of domestic air transport is provided by MIAT, which operates 22 airports, which are also vital for emergency situations. Mongolia’s civil aviation industry received a boost with the addition of private carriers.

MIAT is a member of IATA (the International Air Transport Association), which coordinates airline activity and sets common operating standards. Membership also enables MIAT to do work with foreign airline members. There are 5 private air companies, which mainly undertake charter flights to tourist destinations and flights to alleviate emergency situations. The government policy for civil aviation is to accelerate the participation of private sector, decrease market monopolization and attract foreign investment and cooperation.

A new airport to be built in with soft loan from the Japanese International Cooperation Agency (JICA) is under construction 60 km from Ulaanbaatar in the Khoshigt Valley of SergelenSoum in Tov Aimag. With all attributes of large airports, it will comprise over 30 objects including runways for large airplanes, water, heating and electricity, water treatment facilities, an underground fire hydrant system and other features. The new airport will allow eliminating problems faced by the current airport, increasing the mobilization of its capacity from 73 percent to 98 percent, and reducing flight delays due to unfavorable weather conditions to 2.3- 0.5 percent. Moreover, it will meet all requirements of international civil aviation standards. The project was designed by Japanese Azusa Sekkei Oriental Consulting Company in 2011 which is controlling the construction and installation of equipment. Launched in June 2013, the construction work will finish in early January 2017 as provided by contract. The airport project is valued at JPY 65 billion. It will have four times capacity than existing Chinggis Khan International Airport, expecting to handle 1.7 million passengers and 18,100 flights per annum.

Air Trans, established in 1997 with 100 percent private investment, is the largest international air-ticket sales company, as well as the leading and largest private travel agent successfully continuing its business operations and maintaining its strong position in Mongolia. Air Trans was the first travel agency in Mongolia to receive the IATA Accreditation Certificate and pioneered the introduction of ‘Galileo’, the Airline Global Distribution System (AGDS).

Besides issuing air tickets on behalf of MIAT, Air China, Aeroflot and Korean Air through its offices in Ulaanbaatar, Air Trans has become the official sales agents for airlines, such as, All Nippon Airways, Singapore Airline Thai Airways, Lufthansa, and Air Astana. Air Trans is also the official representative for United Airlines.

Road Building

The road network has been developing since 1929. There is now a network of 49,250km of road or track, of which 1,715km are paved, 1,946km are gravel, and 1,923km are improved earth. There are also 1,6419m of concrete bridging and 1,1287m of wooden bridging. The Roads Department is the government implementing agency todevelop roads, implement government road-related policies, supervise road construction and maintenance bodies and bridge construction and maintenance. Since 1990, the department has been a part of the ESCAP Asian Highway Development Project for routes A-3 and A-83. A proposal for a Road Fund was submitted by the department to the government in 1991 to create permanent investment sources, and it was resolved to put 13 per cent of the proceeds from sales of fuel into this fund.

There are annual traffic surveys and quarterly traffic counts for road network planning. A total of 19 road development projects have been implemented with five loans and 13 technical assistance grants. Sources include the ADB, World Bank, Kuwait Fund for Arabic Development, EU, New Zealand, Japan, the Nordic Development Fund, India and USAI D. Parliament approved involvement in the Millennium Road project (resolution 9, 2001) and instructed the government to arrange implementation of the Road, which will run east and west from Ulaanbaatar.

Mongolia cooperates also with the Kuwait Fund to build a 180.8 km road between Darkhan and Erdenet and a 141.6 km road from Erdenet to Bulgan-Unit. The April 2004 ESCAP (Economic and Social Commission for Asia and the Pacific) meeting in Shanghai, China, reached an intergovernmental agreement on an Asian road network. By joining this agreement, Mongolia will be involved in international transport activities, which will be an important factor accelerating economic growth and social development.

The vertical road route AH-3 of Altanbulag-Zamiin-Uud, a crucial corridor for Mongolian economic development, connects large regional centers with capital city of Ulaanbaatar, plays an important role in meeting freight demands, expanding regional trade and serves as means of facilitating transit transportation through Mongolian territory. This road, an integral part of Asian Highway Network is one of the main routes of the national road system.

The government set a goal to connect centers of all provinces (aimags) to Ulaanbaatar with paved roads in 2012-2016. Within this framework, centers of aimags including Bayankhongor, Dundgobi and Dornogobi, Sukhbaatar, Umnugobi and Khuvsgul Aimag have already been connected to Ulaanbaatar in 2013- 2014.