Basel ABL Index: Money Laundering and Terrorist Financing Risk Reduces in Mongolia

Society

Ulaanbaatar, November 29, 2023

/MONTSAME. Mongolia was put on FATF's gray list in

October 2019 and ranked 20th in the Basel AML Index. However, according to the

Basel Institute on Governance assessment in 2023, Mongolia's money laundering

and terrorist financing (ML/TF) risk score has decreased and it ranks 83rd out

of 152 countries.

The Basel AML Index provides risk scores

based on the quality of a country's anti-money laundering and countering the

financing of terrorism (AML/CFT) framework and the results are presented in the

FATF Mutual Evaluation Report.

In recent years, Mongolia has made

unprecedented progress in combating money laundering and terrorist financing.

Mongolia is leading among the anti-money laundering groups in the Asia-Pacific

region to be fully compliant and assessed as "compliant" and

"largely compliant" on all 40 FATF technical recommendations.

According to the Bank of Mongolia, the progress made by Mongolia will have a

positive impact on other assessments and indexes for assessing the system of

combating money laundering and terrorist financing, as well as cooperation with

foreign banking and financial institutions.

In recent years, Mongolia has made

unprecedented progress in combating money laundering and terrorist financing.

Mongolia is leading among the anti-money laundering groups in the Asia-Pacific

region to be fully compliant and assessed as "compliant" and

"largely compliant" on all 40 FATF technical recommendations.

According to the Bank of Mongolia, the progress made by Mongolia will have a

positive impact on other assessments and indexes for assessing the system of

combating money laundering and terrorist financing, as well as cooperation with

foreign banking and financial institutions.

The State Great Khural and the Cabinet's

support to combat money laundering and terrorist financing at all levels as

well as public and private organizations' prompt actions had a positive impact

on FAFT assessment. The Bank of Mongolia emphasized the necessity to focus on

the implementation and detection of crimes related to money laundering and

terrorist financing, expanding cooperation, quality of preventive measures

aimed at avoiding risks, and strengthening the capacity of human resources and

funding of organizations operating in this area.

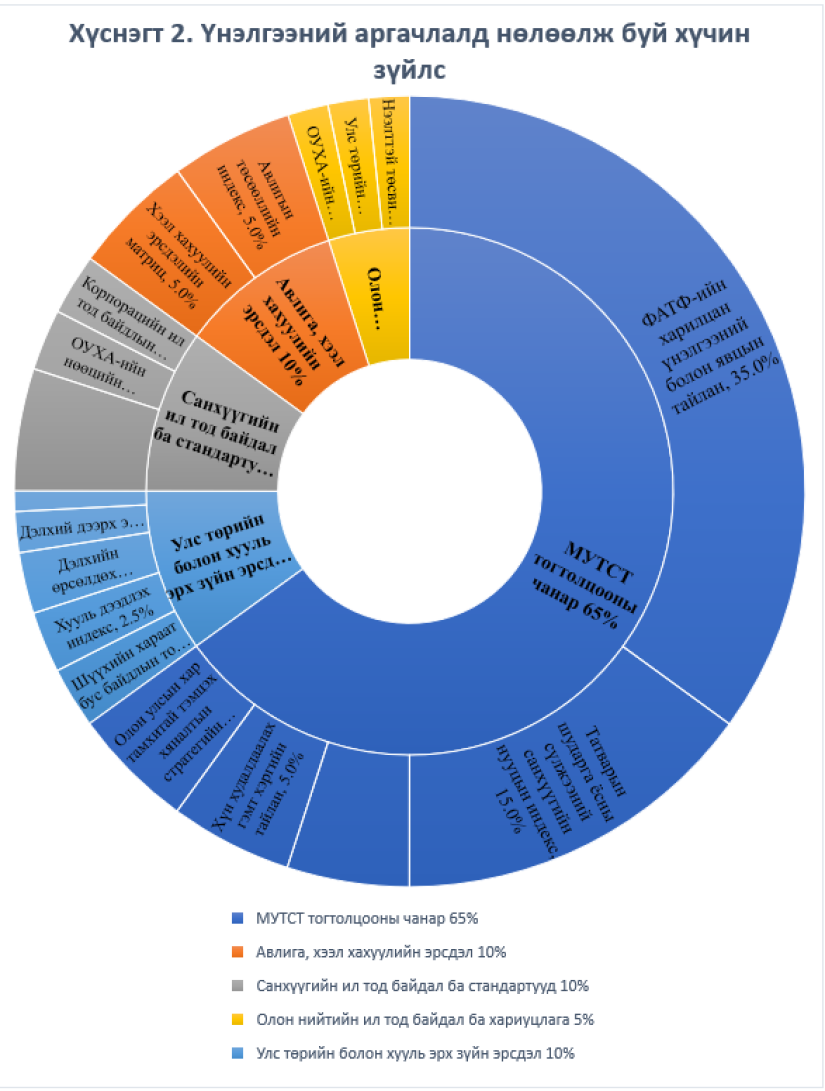

In the Basel AML Index, the risk is

calculated using a special methodology, and the global average is estimated at

5.31. On this list, Haiti was ranked 1st as the country with the highest risk

of money laundering and terrorist financing, while Iceland was ranked 152nd as

the country with the lowest risk.

The Basel Institute on Governance is an

independent not-for-profit organization dedicated to countering corruption,

improving standards of governance and their activities, criminal law

enforcement, combating money laundering and terrorist financing, confiscation,

and return of illegal assets. It annually assesses risks of money laundering

and terrorist financing around the world and publishes the Basel AML Index.

Since there is no single index that

calculates money laundering and terrorist financing risk factors, countries,

governments, and private organizations often use the Basel AML Index to develop

their anti-money laundering and terrorist financing strategies and calculate

risks.

The Basel Institute has been publishing the

Basel AML Index annually since 2012.

It provides risk scores

based on data from 18 publicly available sources such as the Financial Action

Task Force (FATF), Transparency International, the World Bank and the World

Economic Forum.

The risk scores cover five domains

considered to contribute to a high risk of ML/TF:

1.

Quality

of AML/CFT Framework

2.

Bribery

and Corruption

3.

Financial

Transparency and Standards

4.

Public

Transparency and Accountability

5.

Legal

and Political Risks

Ulaanbaatar

Ulaanbaatar