The Bank of Mongolia Raises Policy Interest Rate to 12 Percent

Economy

Ulaanbaatar, March 13, 2025 /MONTSAME/. The Monetary Policy Committee of the Bank of Mongolia made the decision to increase the policy interest rate by two percent during its regular session held on March 6-7, 2025.

As a result, the policy interest rate has been raised to 12 percent. The decision to increase the policy interest rate was driven by the acceleration of inflation, which has reached 9.6 percent, exceeding the central bank’s target level. The surge in electricity prices and its effects, along with heightened economic activity, rising wages, and higher-than-expected increases in the costs of services, rent, and imported goods, have all contributed to inflationary pressures. Consequently, the Bank of Mongolia has shifted away from its previous easing stance at the beginning of 2024 and has now moved toward a tighter monetary policy.

Economic growth reached 4.9 percent in 2024, primarily supported by increased domestic demand, which drove expansion in the trade and services sectors, as well as a rise in net taxes on products. This year, economic growth is expected to be supported by the recovery of the agricultural sector, increased copper concentrate production, and a resurgence in mining activities. Additionally, a more expansionary fiscal stance and the launch of new development projects are anticipated to further stimulate growth. However, uncertainties persist in the external environment due to geopolitical factors and the United States of America's trade and tax policies, leading to expectations of weakened external demand and a relatively gradual decline in benchmark interest rates.

During the regular meeting, the Monetary Policy Committee also decided to set the maximum debt-to-income (DTI) ratio for newly issued and modified consumer loans at 50 percent. Additionally, for pension-backed loans, the committee ruled that after making monthly loan payments, the borrower’s remaining income must not fall below the national minimum subsistence level.

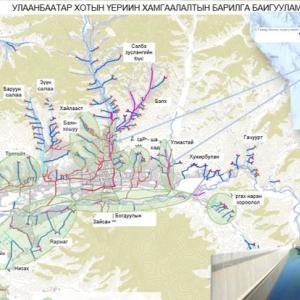

Улаанбаатар

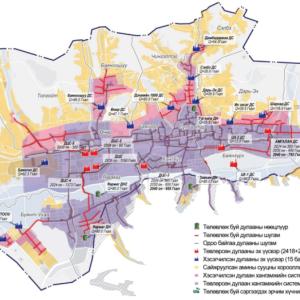

Улаанбаатар