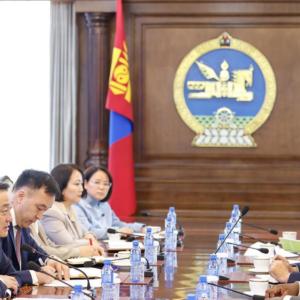

Khan Bank and EBRD sign USD 70 m in new facility agreements

EconomyUlaanbaatar /MONTSAME/ The European Bank for Reconstruction and Development (EBRD) and Khan Bank, one of the largest commercial banks in Mongolia, have signed a package of facility agreements for a total amount of USD 70 million to support Mongolian micro, small- and medium-sized enterprises (MSMEs) and trade finance. The news was reported Monday on the Khan Bank’s website.

The agreements have been signed by Norihiko Kato, CEO of Khan Bank, and Matthieu D.Le Blan, Head of EBRD’s Mongolia Resident Office.

Facilities include a USD 30 million senior loan for long term financing for promoting MSMEs and Value Chain Financing (VCF), USD 10 million for Sustainable Energy Efficiency projects, USD 10 million for financing MSMEs under Direct Risk Sharing Program, and USD 20 million increase in Khan Bank’s existing trade credit line for supporting trade finance business.

Khan Bank has a long term relationship with EBRD. EBRD’s strong support has enabled Khan Bank to provide the MSME sector with long term, innovative lending.

During the signing ceremony, Norihiko Kato, CEO of Khan Bank commented: “We are delighted to continue our partnership with EBRD and very much appreciate their support in long term funding and introducing new facility that to support our customers’ businesses in the energy efficiency, value chain financing and risk sharing program with EBRD.

Head of EBRD’s Mongolia Resident Office Matthieu D. Le Blan said: “The MSME/VCF Loan will contribute to market expansion by increasing the availability of longer tenor funding to private MSMEs, including areas outside of Ulaanbaatar. The Energy Efficiency Loan will contribute to a positive demonstration of energy efficiency investments and promotion of products new to the economy as well as to building capacity of Khan Bank in sustainable energy lending. The Risk Sharing Facility will further enhance the competition in the Mongolian banking sector by enabling Khan Bank to service the lending needs of large and medium-sized private clients in longer-term loans. The increase in the TFP limit will support the development of Khan Bank’s trade finance business and export-import operations of its corporate clients,”

During the decline of foreign direct investment and slowdown of economic growth, by receiving a large amount of financing from the prestigious international financial institution, Khan Bank has strengthened its capacity to continue providing long-term lending services to its customers and business entrepreneurs, and to expand its operational scope into wider areas.

Улаанбаатар

Улаанбаатар